With the midterm elections behind us and the start of a divided government ahead of us, additional tax law changes could make their way through Congress in the remainder of 2022 as well as 2023.

Over 135 Tax Strategies to Consider in a Changing Economic and Tax Environment

A lot has changed in the past year. As the world has put the pandemic in the rearview mirror, 2022 has seen an increasingly challenging economic environment, originally stemming from supply chain issues and more recently exacerbated by market volatility and persistent inflation. As we enter the holiday season after another difficult year, we hope that you, your family and your loved ones are safe and healthy and can find some light in this season.

As we near the end of the year, there is still time to position yourself to take advantage of the opportunities afforded under the current tax law to reduce your 2022 tax liability. Our 2022 Year-End Tax Planning Guide highlights select and noteworthy tax provisions and potential planning opportunities to consider for this year and, in some cases, 2023.

Amid the economic uncertainty, which has lingered in the background for much of this year, Congress considered many significant tax changes in 2022, some of which were enacted into law in August with the Inflation Reduction Act (though greatly diminished in size and scope from initial proposals). Among other provisions, the Inflation Reduction Act included new and extended energy tax credits, increased IRS funding for enforcement and two new taxes affecting large corporations. Perhaps more noteworthy was that the most highly debated and publicized tax provisions included in the Build Back Better Act were dropped from the final version of the Inflation Reduction Act, including:

- No changes to the carried interest rule, which would have limited the ability of private equity and hedge fund managers to classify income as capital gains.

- No repeal to the $10,000 state and local tax itemized deduction limitation.

- No changes to the estate and gift tax rules.

- No increase to the favorable long-term capital gain tax rates.

- No increase to individual ordinary income tax rates.

- No increase to the corporate income tax rate.

With the midterm elections behind us and the start of a divided government ahead of us, additional tax law changes could make their way through Congress in the remainder of 2022 as well as 2023. However, divided government will usually limit the scope of new tax legislation.

For 2022, with a new fiscal year budget due by December 16, any year-end tax legislation on the horizon would be bipartisan provisions that could be tacked on during the budget reconciliation process. Republican members of Congress will likely advocate for the extension of certain provisions in the Tax Cuts and Jobs Act of 2017, which changed in 2022, such as the tax treatment of research and development expenses and business interest. Meanwhile, Democratic members of Congress may look to extend certain expired provisions in the American Rescue Plan Act of 2021, such as the expanded child tax credit. Some items that could garner bipartisan support include the SECURE Act 2.0 proposals currently pending and narrowing the tax gap through cryptocurrency legislation and clarifications. Can bipartisan support be achieved? Time will tell.

For 2023 (technically, after January 3), with a Republican-controlled House and Democratic-controlled Senate, significant tax legislation is expected to be limited, especially as each party will do their best to position themselves for the next election cycle.

Please check in with us and keep a watchful eye on our Alerts published throughout the year, which contain information on tax developments and are designed to keep you informed while offering tax-saving opportunities.

In this 2022 Year-End Tax Planning Guide prepared by the CPAs, attorneys and enrolled IRS agents of the Tax Accounting Group of Duane Morris LLP, along with contributions from the trust and estate attorneys of our firm’s Private Client Services Practice Group, we walk you through the steps needed to assess your personal and business tax situation in light of both existing and potential new laws, and identify actions needed before year-end and beyond to reduce your 2022 and future tax liabilities.

We hope you find this complimentary guide valuable and invite you to consult with us regarding any of the topics covered or your own unique situation. For additional information, please contact me, Michael A. Gillen, at 215.979.1635 or magillen@duanemorris.com, John I. Frederick, Steven M. Packer or the practitioner with whom you are regularly in contact.

We wish you a joyous holiday season and a healthy, peaceful and successful new year.

Michael A. Gillen

Tax Accounting Group

About Duane Morris LLP

Duane Morris LLP, a law firm with more than 900 attorneys in offices across the United States and internationally, is asked by a broad array of clients to provide innovative solutions to today’s legal and business challenges. Evolving from a partnership of prominent lawyers in Philadelphia a century ago, Duane Morris’ modern organization stretches from the U.S. to Europe and across Asia. Throughout this global expansion, Duane Morris has remained committed to preserving its collegial, collaborative culture that has attracted many talented attorneys. The firm’s leadership, and outside observers like the Harvard Business School, believe this culture is truly unique among large law firms and helps account for the firm continuing to prosper throughout changing economic and industry conditions. Most recently, Duane Morris has been recognized by BTI Consulting as both a client service leader and a highly recommended law firm. Additionally, multiple Duane Morris office locations have received recognition as top workplaces for the seventh consecutive year.

At a Glance

- Offices in 24 U.S. cities in 12 states and the District of Columbia

- Offices in Asia and Europe, and liaisons in Latin America

- More than 1,600 people

- More than 900 lawyers

- AM Law 100 since 2001

- U.S. News Best Lawyers/Best Law Firms 2023

- BTI Consulting highly recommended firm

- Mansfield 5.0 Certification Plus status

In addition to legal services, Duane Morris is a pioneer in establishing independent affiliates providing nonlegal services to complement and enhance the representation of our clients. The firm has independent affiliates employing more than 100 professionals engaged in other disciplines, such as the tax, accounting and litigation consulting services offered by the Tax Accounting Group.

About the Tax Accounting Group

Recently celebrating our 40th anniversary, the Tax Accounting Group (TAG) was the first ancillary practice of Duane Morris LLP and is one of the largest tax, accounting and litigation consulting groups affiliated with any law firm in the United States. TAG has an active and diverse practice with over 60 service lines in more than 45 industries, serving as the entrusted adviser to clients in nearly every U.S. state and 25 countries through our regional access, national presence and global reach. In addition, TAG continues to enjoy impressive growth year over year, in large part because of our clients’ continued expression of confidence and referrals. To learn more about our service lines and industries served, please refer to our Quick Reference Service Guide.

TAG’s certified public accountants, certified fraud examiners, attorneys, financial consultants and advisers provide a broad range of cost-effective tax compliance, planning and consulting services as well as accounting, financial and management advisory services to individuals, businesses, estates, trusts and nonprofit organizations. TAG also provides an array of litigation consulting services to lawyers and law firms representing clients in regulatory and transactional matters and throughout various stages of litigation. Our one-of-a-kind CPA and lawyer platform allows us to efficiently deliver one-stop flexibility, customization and specialization to meet each of the traditional, advanced and unique needs of our clients, all with the convenience of a single-source provider.

We serve clients of all types and sizes, from high-net-worth individuals to young and emerging professionals, corporate executives to entrepreneurs, multigenerational families to single and multifamily offices, mature businesses to startups, global professional service firms to local companies, and foundations and nonprofits to governmental entities. We assist clients with a wide range of services, from traditional tax compliance to those with complex and unique needs, conventional tax planning to advanced strategies, domestic to international tax matters for clients working abroad as well as foreign businesses and individuals working in the United States, traditional civil tax representation to those criminally charged, those in need of customary accounting, financial and management advisory services, to those requiring innovative consulting solutions and those in need of sophisticated assistance in regulatory and transactional matters and throughout various stages of litigation.

With our service mission to enthusiastically provide effective solutions that exceed client expectations, and the passion, objectivity and deep experience of our talented professionals, including our dedicated senior staff with an average of over 25 years working together as a team at TAG (with a few having more than 30 years on our platform), TAG is truly distinctive. Being “truly distinctive and positively effective” is not just our TAGline, it is our way of life.

Whether you are a client new to TAG or are among the many who have been with us the entire 40-plus years, it is our honor and privilege to serve you.

As we complete another trip around the sun, we are again fielding calls, outreaches and multiyear tax modeling requests from existing and new clients regarding year-end tax planning strategies available to individuals, businesses, estates, trusts and nonprofits. While some significant legislation has passed this year in the form of the Inflation Reduction Act, we have also gained more certainty over future tax rates and provisions in the past year. Now that the midterm elections have concluded and we are looking at a split Congress, the hopes for significant tax changes seem dim. This year sees a heightened level of predictability on where the tax code will be for 2023 and possibly for the next few years―which increases the ability to plan for the future.

For much of this year, the Biden administration attempted to pass the major tax changes contemplated in the Build Back Better Act bill, which we discussed in depth in last year’s guide. Several of the tax provisions in the Build Back Better Act were enacted as part of the Inflation Reduction Act in August. The Inflation Reduction Act included: (1) over 30 new and extended energy credits and provisions; (2) increased IRS funding to improve customer service and increase audits; (3) extension of the excess business loss limitation by two years; (4) enactment of a new corporate alternative minimum tax based on financial statement income; and (5) a new 1 percent excise tax on stock buybacks for publicly traded companies.

A number of tax provisions expired at the end of 2021, including:

- Enhanced child tax credit (see item 7);

- Refundable, enhanced child and dependent care credit (see item 6);

- Charitable contribution deduction for nonitemizers (see item 5);

- Temporarily enhanced dependent care benefits (see item 61);

- Business interest (see item 18); and

- Research and development expensing (see item 86).

In the lame duck session, Congress may seek to tack extensions of some or all of the above expired provisions onto the upcoming budget, which it needs to pass by December 16. Three bills currently remain before Congress that encapsulate the SECURE Act 2.0, which may pass with bipartisan support (see item 48).

Tax provisions regarding cryptocurrency also have the potential to garner bipartisan support in the lame duck session or next year in the split Congress. Most notably, lawmakers on both sides of the aisle are concerned about the broad definition of “broker” under the Infrastructure Investment and Jobs Act of 2021, which may subject nonfinancial intermediaries to increased reporting requirements. In addition, some pending proposals include an exemption for gains of less than $200 in personal transactions and deferring tax liabilities for mining and staking rewards.

While you can depend on TAG for cost-effective tax compliance, planning and consulting services, as well as critical advocacy and prompt action in connection with your long-term personal and business objectives, we are also available for any immediate or last-minute needs you may have or those that Congress may legislate that impact your personal or business tax situation.

With only minor tax changes expected for 2023, the tried-and-true strategies of deferring income and accelerating deductions may be beneficial in reducing tax obligations for most taxpayers in 2022. With minor exceptions, this month is the last chance to develop and implement your tax plan for 2022, but it is certainly not the last opportunity.

For example, if you expect to be in the same tax bracket in 2023 as 2022, deferring taxable income and accelerating deductible expenses can possibly achieve overall tax savings for both 2022 and 2023. However, by reversing this technique and accelerating 2022 taxable income and/or deferring deductions to plan for a higher 2023 tax rate, your two-year tax savings may be higher. This may be an effective strategy for you if, for example, you have charitable contribution carryovers to absorb, your marital status will change next year or your head of household or surviving spouse filing status ends this year. This analysis can be complex, and you should seek professional guidance before implementation. Examine our “Words of Caution” section below for additional thoughts in this regard.

This guide provides tax planning strategies for corporate executives, businesses, individuals, nonprofit entities and trusts. We hope that this guide will help you leverage the tax benefits available to you presently, reinforce the tax savings strategies you may already have in place, or develop a tax-efficient plan for 2022 and 2023.

To help you prepare for an uncertain year-end, below is a quick reference guide of action steps, organized by several common individual scenarios, which can help you reach your tax-minimization goals as long as you act before the clock strikes midnight on New Year’s Eve. Not all of the action steps will apply in your particular situation, but you could likely benefit from many of them. Taxpayers may want to consult with us to develop and tailor a customized plan with defined multiyear tax modeling to focus on the specific actions that you are considering. We will be pleased to help you analyze the options and decide on the strategies that are most effective for you, your family and your business.

Whether you should accelerate taxable income or defer deductions between 2022 and 2023 largely depends on your projected highest (aka marginal) tax rate for each year. While the highest official marginal tax rate for 2022 is currently 37 percent, you might pay more tax than in 2021 even if you were in a higher tax bracket due to credit fluctuations, compositions of capital gains and dividends, and a myriad of other reasons.

The chart below summarizes the most common 2022 tax rates together with the corresponding taxable income levels presently in place. Effective management of your tax bracket can provide meaningful tax savings, as a change of just $1 in taxable income can shift you into the next higher or lower bracket. These differences can be further exacerbated by other income thresholds throughout the code, discussed later in this guide, such as those for determining eligibility for the child tax credit and qualified business income deductions, among others. Income deferral and acceleration, while being mindful of bracket thresholds, can be accomplished through numerous income strategies discussed in this guide, such as retirement distribution planning, bonus acceleration or deferral, and harvesting of capital gains and losses.

2022 Federal Income Tax Rate Schedule

|

Tax Rate |

Single |

Head of Household |

Married Couple |

|

10% |

$0 - $10,275 |

$0 - $14,650 |

$0 - $20,550 |

|

12% |

$10,276 - $41,775 |

$14,651 - $55,900 |

$20,551 - $83,550 |

|

22% |

$41,776 - $89,075 |

$55,901 - $89,050 |

$83,551 - $178,150 |

|

24% |

$89,076 - $170,050 |

$89,051 - $170,050 |

$178,151 - $340,100 |

|

32% |

$170,051 - $215,950 |

$170,051 - $215,950 |

$340,101 - $431,900 |

|

35% |

$215,951 - $539,900 |

$215,951 - $539,900 |

$431,901 - $647,850 |

|

37% |

Over $539,900 |

Over $539,900 |

Over $647,850 |

While reviewing this guide, please keep the following in mind:

- Never let the tax tail wag the financial dog, as we often preach. Always assess economic viability. This guide is intended to help you achieve your personal and business financial objectives in a “tax efficient” manner. It is important to note that proposed transactions should make economic sense in addition to generating tax savings. Therefore, you should review your entire financial position prior to implementing changes. Various nontax factors can influence your year‑end planning, including a change in employment, your spouse reentering or exiting the work force, the adoption or birth of a child, a death in the family or a change in your marital status. It is best to look at your tax situation for at least two years at a time with the objective of reducing your tax liability for both years combined, not just for 2022. In particular, multiple years should be considered when implementing “bunching” or “timing” strategies, as discussed throughout this guide.

- Be very cautious about accelerated timing causing you to lose too much value, including the time value of money. That is, any decision to save taxes by accelerating income must consider the possibility that this means paying taxes on the accelerated income earlier, which would require you to forego the use of money used to satisfy tax liabilities that could have been otherwise invested. Accordingly, the time value of money can make a bad decision worse or, hopefully, a good decision better―a delicate balance, indeed.

- While the traditional strategies of deferring taxable income and accelerating deductible expenses will be beneficial for many taxpayers, with exceptions, you can often achieve overall tax efficiency by reversing this technique. For example, waiting to pay deductible expenses such as mortgage interest until 2023 would defer the tax deduction to 2023. Or, waiting to pay state and local taxes (SALT) until 2023 if you have already paid SALT of $10,000 in 2023 could also be worthwhile. You should consider deferring deductions and accelerating income if you expect to be in a higher tax bracket next year, you have charitable contribution carryovers to absorb, your marital status will change next year or your head of household or surviving spouse filing status ends this year. This analysis can be complex, and you should seek professional guidance before implementation.

- Both individuals and businesses have many ways to “time” income and deductions, whether by acceleration or deferral. Businesses, for example, can make different types of elections that affect the timing of significant deductions. Faster or slower depreciation, including electing in or out of bonus depreciation, is one of the most significant. This type of strategy should be considered carefully as it will not simply defer a deduction into the following year but can push the deduction out much further or spread it over a number of years.

With these words of caution in mind, the following are observations and specific strategies that can be employed in the waning days of 2022 regarding income and deductions for the year, where the tried-and-true strategies of deferring taxable income and accelerating deductible expenses will result in maximum tax savings.

With the passage of the Inflation Reduction Act in August, the Internal Revenue Service will be receiving an additional $80 billion over the next 10 years to increase enforcement activity, improve customer service and update computer systems. Even without this additional funding, audits on high-net-worth and ultra-high-net-worth individuals and other targeted groups were poised to rise as the IRS recovered from the pandemic.

Of the approximately $80 billion in funding earmarked toward the IRS in the Inflation Reduction Act, about $45.6 billion is targeted toward enforcement actions, an increase of almost 70 percent in the enforcement budget over the prior 10-year allotment of $66 billion. Even prior to the passage of the act, the IRS Chief Counsel’s Office earlier this year announced that it was looking to hire 200 experienced attorneys to focus on abusive tax schemes. With this additional funding, more staffing gains are certainly coming.

Even though a large amount of additional funding is available immediately, the IRS may have trouble hiring and bringing on capable staff quickly―although former IRS Commissioner Charles P. Rettig has said they would direct efforts to hiring experienced tax and audit practitioners so revenue gains from enforcement would not be delayed. The Congressional Budget Office estimates that the additional $80 billion in IRS funding will generate an additional $200 billion in tax collection over a 10-year period.

With President Biden heading the executive branch, it is very likely for any additional funding for enforcement to strictly target high-net-worth individuals as well as other select groups. The prior version of his proposed legislation, the Build Back Better Act, specifically stated that “no use of these funds is intended to increase taxes on any taxpayer with taxable income below $400,000,” consistent with the president’s campaign promises. While the Inflation Reduction Act does not contain a similar provision in the body of the law, on August 10, Treasury Secretary Janet Yellen directed in a letter to the IRS commissioner that any additional resources will not be used to increase the audit rate for businesses or households below this $400,000 threshold.

More recently, at the American Bar Association’s 33rd annual Philadelphia Tax Conference in November, the acting commissioner of the IRS Large Business and International Division noted that the division will be increasing its focus on partnerships (one of our projected targeted groups). This looks to be a continuation and expansion of the IRS’ Large Partnership Compliance Program, which started examining applicable returns last fall. This program began its focus on partnerships with assets in excess of $10 million, and with increased funding, it looks poised to grow.

As the year comes to a close, now is the time to look ahead, improve your recordkeeping and be prepared to defend yourself against increased enforcement. If you are contacted by the IRS and informed that your tax return or a component of your return is being audited or adjusted, it is imprudent to ignore it. But we do urge caution here―do not respond directly. Instead, seek the counsel of qualified tax advisers.

For those high- and ultra-high-net-worth individuals, businesses and others (including those noted throughout this guide, such as cryptocurrency and digital asset owners) who are targeted groups in recent or new IRS compliance initiatives, the time to develop a plan and maintain documentation is now. In advance of any IRS examination, you may wish to work with experienced tax counsel to conduct a simulated audit to assess exposure and mitigate risk. We recommend that those taxpayers with exposure should engage truly independent tax lawyers and CPAs who fall under attorney-client privilege to represent your interests, such as those in our National Tax Controversy Group. For more information on our National Tax Controversy Group and how to prepare yourself for an audit, see our prior Alert.

Below is a quick and easy reference guide of action steps that can help you reach your tax-minimization goals, as long as you act before year end. In this guide, we have identified the best possible action items for you to consider, depending on how your income shapes up as the year draws to a close.

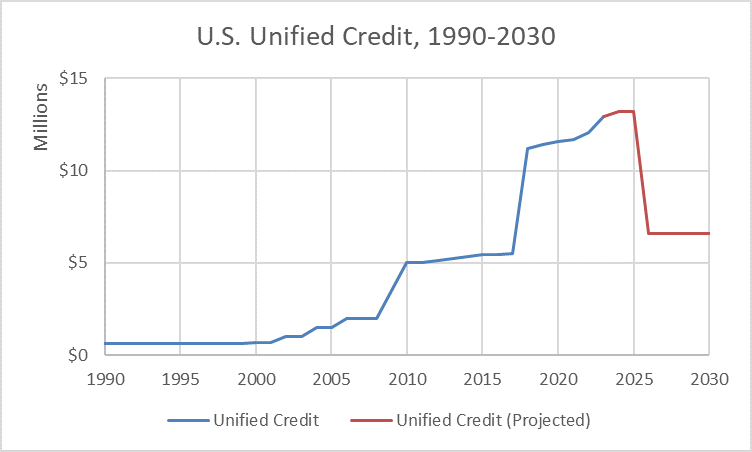

Not all of the action steps will apply in your particular situation, and some may be better for you than others. In addition, several steps can be taken before year-end that are not necessarily “quick and easy” but could yield even greater benefits. For example, perhaps this is the year that you finally set up your private foundation to achieve your charitable goals (see item 113) or maybe you decide it is time to review your estate plan in order to utilize the current unified credit (see items 116-130). Consultation to develop and tailor a customized plan focused on the specific actions that should be taken is paramount.

To help guide your thinking and planning in light of the multiple situations in which you may find yourself at year-end, we have compiled Quick-Strike Action Steps that follow different themes depending on several common situations. Due to the changing legislative environment, you may wish to consider several situations below and identify the most relevant and significant steps for your particular situation.

Quick-Strike Action Step Themes

|

Situation |

Reason |

Theme |

Action |

|

You expect higher ordinary tax rates in 2023 |

Increased income Getting married, subject to marriage penalty |

Accelerate income into 2022 Defer deductions until 2023 |

Accelerate installment sale gain into 2022 (item 105) Defer SALT payments to 2023 (item 26) Bunch itemized deductions (item 28) |

|

You expect lower ordinary tax rates in 2023 |

Retirement Income goes down

|

Accelerate deductions into 2022 Defer income until 2023 |

Defer income until 2023 (item 4) Maximize medical deductions in 2022 (item 25) Prepay January mortgage (item 27) Consider deduction limits for charitable contributions (items 29 and 30) Sell passive activities (item 46) Increase basis in partnership and S corporation to maximize losses (item 47) Maximize pre-tax retirement contributions (item 49) Maximize contributions to FSAs and HSAs (items 61 and 62) |

|

You have high capital gains in 2022 |

Business or property sold An investment ends Employee stock is sold |

Reduce or defer gains |

Invest in qualified opportunity zones (item 11) Invest in 1202 small business stock (item 35) Perform a like-kind exchange (item 43) Harvest losses (item 34) |

|

You have low capital gains in 2022 |

Carry forward losses |

Increase capital gains |

Maximize preferential gains rates (item 32) |

1. Receive payments through Venmo, PayPal, CashApp, Uber, DoorDash or Airbnb in 2022? Expect a Form 1099-K in early 2023 due to lower thresholds. For calendar year 2022 and after, a Form 1099-K will be issued when gross payment card transactions for goods or services exceed $600, with no minimum transaction threshold. Prior to the change, the 1099-K filing threshold required $20,000 in gross amounts and more than 200 transactions in a calendar year. If you earn income by providing goods or services through a payment settlement entity or a third-party payment network (such as those listed above), expect to receive a Form-1099K in late January 2023 if you meet the new threshold. For anyone accepting digital payments, even if you’re just splitting a meal out with friends, this could mean a new tax form being received for the first time in early 2023.

2. Be aware of the Inflation Reduction Act’s new or expanded energy credits. While the Biden administration’s ambitious Build Back Better Act could not garner the requisite support in Congress to secure the passage of many tax provisions, a myriad of new environmental and energy provisions were contained in the Inflation Reduction Act of 2022, which became law in August 2022. Please see item 68 for a chart summarizing these credits. Some tax credits that may be of interest to individuals and small businesses include:

Energy Efficient Home Improvement Credit

Previously named the nonbusiness energy property credit, this credit has been extended through 2032. The credit is available to taxpayers who made qualifying, energy-efficient improvements to their homes. Beginning with 2023, the available credit will be 30 percent of the costs of all eligible home improvements made during the year. The previous lifetime limit of $500 for the total credit will be increased to a $1,200 annual limit, effective January 1, 2023.

Residential Clean Energy Credit

Previously named the residential energy efficient property credit, this credit was scheduled to sunset at the end of 2023 but has now been extended through 2034. The credit is available for taxpayers who installed solar electric, solar hot water, fuel cell, small wind energy, geothermal heat pump and biomass fuel property in their homes. The Inflation Reduction Act increased the maximum percentage available for the credit in 2022 (from 26 percent to 30 percent) and will phase out toward the extensions’ end of life (30 percent in 2022-2032, 26 percent for 2033 and 22 percent in 2034). The credit will no longer be available to installations of biomass heaters and furnaces that were previously eligible, but starting in 2023, the credit will apply to battery storage technology that meets certain capacity requirements.

New Energy Efficient Home Credit

This credit was available to homebuilders or contractors who manufactured energy-efficient homes through the end of 2021. The available credit was either $1,000 or $2,000 depending on which requirements were satisfied. The credit has been extended and expanded by the Inflation Reduction Act, and is now available through the end of 2032. The maximum available credit has also been increased to $2,500.

- Electric or natural gas heat pump water heaters;

- Electric or natural gas heat pumps;

- Central air conditioners;

- Natural gas, propane or oil water heaters;

- Certain natural gas, propane or oil furnace or hot water boilers;

- Certain biomass stoves or boilers; and

- Electrical panel upgrades necessary for other efficiency improvements.

If your desired property meets the expanded definitions, it may be better to wait to install your property until January 2023 when the provisions under the Inflation Reduction Act go into effect. In addition, the energy efficient home improvement credit will see increased limitations in 2023, so if you are considering one of these properties, it may be best to defer to 2023.

Additionally, because of the expanded qualifying property, Congress deemed that more record retention and identification is required. Starting in 2025, manufacturers and taxpayers must comply with reporting the identification number of certain credit property. We suggest retaining all documents, starting now, related to your installation from both the manufacturer of the property and the installer.

3. Take advantage of new and expanded electric vehicle credits. In addition to the home-related energy credits detailed in the previous section, the Inflation Reduction Act also introduced or extended several credits related to vehicles:

New Clean Vehicle Credit

This was previously named the qualified plug-in electric drive motor vehicle credit and was available for each new plug-in electric drive motor vehicle placed in service during the tax year. In addition to extending the credit through 2032, the act also eliminates the limitation on the number of vehicles eligible for the credit and stipulates that the final assembly of the vehicle must take place in North America.

Credit for Previously Owned Clean Vehicles

This credit is allowed for any previously owned clean vehicle purchased and placed into service after 2022 and is limited to the lesser of $4,000 or 30 percent of the vehicle’s sale price. The credit is disallowed if the buyer meets certain income thresholds, as well as a $25,000 maximum price paid for the vehicle.

New Credit for Qualified Commercial Clean Vehicles

This credit is new and available for any qualifying vehicles acquired and placed in service after December 31, 2022. The maximum credit is impacted by the vehicle’s weight, as vehicles in excess of 14,000 pounds can receive a maximum credit of $40,000, while lighter vehicles are limited to $7,500. The credit for each vehicle is the lesser of either: (1) 15 percent of the vehicle’s basis (30 percent for vehicles not powered by gas or diesel); or (2) the “incremental cost” of the vehicle above what the price for a comparable gas- or diesel-powered vehicle would be.

If you purchase and/or take possession of a qualifying electric vehicle between August 16, 2022, and January 1, 2023, the final assembly requirement will apply but otherwise will be subject to the rules existing prior to the enactment of the Inflation Reduction Act. It is important to consider the timing of any purchase of qualifying electric vehicles in order to maximize the tax benefits.

4. Defer income until 2023 to take advantage of inflation adjustments to tax brackets. For 2022, the top individual tax rate remains 37 percent and is applied to joint filers with taxable income greater than $628,301 and single filers with taxable income greater than $523,601. These thresholds will rise in 2023 to $693,750 for joint filers and $578,125 for single filers. It might be advantageous for many taxpayers to accelerate their deductions into 2022, reducing their potential tax liability this year. Additionally, for those who are able, taxpayers should plan to defer income into 2023 to take full advantage of the threshold increases to the tax brackets. While there are many ways to defer your income, waiting to recognize capital gains or exercise stock options are popular options that would not only lower your investment income, but your taxable income as well. Depending on your situation, these strategies could reduce tax due for 2022 and potentially 2023 as well.

5. Be cognizant of COVID-related charitable deductions that have lapsed. For tax years 2020 and 2021, the adjusted gross income (AGI) limitation on charitable contributions made by cash to public charities was increased to 100 percent. This benefit was not extended into 2022 and, as a result, the charitable contribution rules have reverted back to the 60 percent AGI limit on cash contributions (30 percent of AGI for noncash contributions). Another benefit that was not extended into 2022 was the $300 above-the-line charitable deduction for single filers ($600 for joint filers) who did not itemize deductions.

Before making a large contribution, please consult with us to determine the impact on your unique situation and the increased documentation that may be required.

6. Maximize child and dependent care credits. For tax year 2022, the child and dependent care credit will also revert to 2020 levels. The American Rescue Plan Act made the child and dependent care credits refundable for 2021 only. In 2022, taxpayers must have an AGI of less than $15,000 in order to get the maximum credit of $1,050 for one child or $2,100 for two or more children.

However, the phaseout range has also changed back to 2020 levels for higher income taxpayers. For 2022, there is no limit to a taxpayer’s AGI in qualifying for the credit. Thus, in 2022, middle-income taxpayers will receive credit for a smaller amount of their expenses than in 2021, but higher income taxpayers who were phased out completely in 2021 can now claim the credit again.

Percentage of Expenses Available for Credit (Based on Income)

|

|

35% |

34% to 21% |

20% |

|

Adjusted gross income |

$0 to $15,000 |

$15,001 to $43,000 |

$43,001 and above |

7. The 2021 enhanced child tax credit is no more for 2022. The American Rescue Plan Act significantly enhanced the child tax credit for tax year 2021 due to the COVID-19 pandemic. However, it reverted to its pre-pandemic levels for 2022. For 2022, the credit returns to a maximum of $2,000 per dependent under the age of 17. Children who are 17 years old do not qualify for the credit this year, because the former age limit (16 years old) returns. As in the years before 2021, the credit begins to phase out at incomes above $400,000 for married filing jointly taxpayers and $200,000 for any other taxpayer status.

In 2022, the tax credit will again be refundable only up to $1,500 (up from $1,400 in 2020 to adjust for inflation), depending on your income, and you must have earned income of at least $2,500 to even be eligible for the refund.

Phaseout Range of Child Tax Credit by Modified Adjusted Gross Income

|

|

Single/Married Filing Separately |

Head of Household |

Married Filing Jointly |

|

Child tax credit – standard $2,000 per child |

$200,000 - $240,000 |

$200,000 - $240,000 |

$400,000 - $440,000 |

8. Report 2020 COVID-19 retirement distributions on 2022 tax returns. In 2020, individuals who were either infected with COVID-19, had a family member with COVID-19 or experienced adverse financial consequences related to COVID-19 were eligible to take up to $100,000 worth of distributions from their retirement plans and include the distributions as income ratably over a three-year period. Since 2022 is the final year of this period, remember that your 2022 taxable income may include a pro rata portion of one of these distributions.

9. Claim a deduction for casualty and disaster losses. In 2022, Florida suffered major damages from Hurricane Ian that led to a federally declared emergency in the state. On September 29, 2022, the IRS announced tax relief for victims of Hurricane Ian that reside or have a business anywhere in the state of Florida. In addition to the option of claiming disaster-related casualty losses, the IRS has also postponed until February 15, 2023 certain tax-filing and tax-payment deadlines falling on or after September 23, 2022 and before February 15, 2023. This extension applies to the quarterly estimated tax payment normally due on January 17, 2023.

Puerto Rico also endured damages from Hurricane Fiona that resulted in a federally declared emergency. In addition, other states had federally declared disasters for damages caused by other storms, floods and wild fires. If you have any questions about whether an event qualifies, please do not hesitate to ask for clarification.

For tax purposes, any losses attributed to a federally declared emergency in 2022 can be pushed back into 2021, such as the closure of stores, losses on mark-to-market securities and permanent retirement of fixed assets. However, lost revenues and the decline in fair market value of property as a direct result of economic hardships would not constitute a loss under disaster rules.

For victims of these disasters that have not yet filed their 2021 tax returns, these losses can be included with their 2021 returns filed prior to the extended filing deadline of February 15, 2023. For those that have already filed 2021 returns, it is still possible for taxpayers to go back and amend 2021 filings, especially if 2021 profits could be offset with 2022 disaster losses. The subject of disaster losses remains a very complicated matter, and there are many rules and stipulations that would prevent taxpayers from taking advantage of the election. There are also certain reasons why taxpayers would not want to make the election and for these reasons, we recommend consulting with us before delving into the amendment process.

10. Consider a solar installation to capitalize on the expanded credit. With the passage of the Inflation Reduction Act in August, the solar investment tax credit has increased from 26 percent to 30 percent of eligible expenses for projects installed between 2022 and 2032. After 2032, this credit will drop to 26 percent of eligible expenses in 2033 and 22 percent in 2034.

11. Invest in qualified opportunity zones to save on capital gains. Gains can be deferred on the sale of appreciated stock that is reinvested within 180 days into a qualified opportunity fund (QOF). This gain is deferred until the investment is sold or December 31, 2026, whichever is earlier. An individual is able to defer a capital gain as long as the property was sold to an unrelated party. In addition to the deferral of gain, once the taxpayer has held the QOF investment for five years, they are able to increase their basis in the asset by 10 percent of the original gain. Due to this five-year holding period requirement, the QOF investment must have been acquired by December 31, 2021, in order to benefit from this basis step-up.

Although the contribution deadline for this basis increase has passed, a QOF still provides taxpayers the ability to defer capital gains until 2026 or the year in which the investment is sold, whichever is earlier. In addition, tax on the appreciation of the QOF may be avoided if the investment is held for over 10 years.

All states have communities that now qualify. Besides investing in a fund, one can also take advantage of this opportunity by establishing a business in the qualified opportunity zone or by investing in qualified opportunity zone property.

12. Remit any payroll tax deferrals by December 31. Under the CARES Act, many employers and self-employed individuals were able to defer deposit and payment of the employer portion of Social Security taxes and self-employment taxes for 2020. Portions of these taxes related to income earned between March 27, 2020, and December 31, 2020, could be deferred, with 50 percent due by December 31, 2021, and the remaining balance due by December 31, 2022. The IRS has recently issued courtesy CP256V notices to taxpayers that elected this deferral of tax as a reminder to remit the final deferred amount on or before December 31, 2022.

If deferral was a part of the tax planning strategy utilized in 2020, it is important that you deposit the final 50 percent of the deferred amount by December 31, 2022. If the remaining balance is not paid by this date, failure to deposit penalties will accrue on the entire amount back to the original deposit due date (over two and a half years).

13. “Welcome” in the new corporate alternative minimum tax. To help pay for the many clean energy tax credits and incentives in the Inflation Reduction Act, a new corporate alternative minimum tax was created. Unlike the pre-2018 corporate alternative minimum tax, which was imposed on taxable income as adjusted, the new corporate alternative minimum tax is imposed on adjusted financial statement income.

Are You Subject to the New AMT?

The new AMT applies only to applicable corporations whose average annual adjusted financial statement income for the three-tax-year period ending with the current tax year exceeds $1 billion. However, special rules apply to members of a multinational group with a foreign parent, which cause the new AMT to apply if the average adjusted financial statement income for the corporation equals or exceeds $100 million. In addition, there are a number of aggregation rules, under which related businesses may be aggregated for purposes of the income test, including a rule that includes income of a partnership in which the corporation is a partner.

What Does Adjusted Financial Statement Income Include?

The new corporate AMT starts with the applicable financial statement, which is a certified statement prepared according to general accepted accounting principles. Therefore, the start to the new corporate AMT will generally be Form 10-K filed with the SEC, or for nonregistrants, the latest annual audited financial statements. This financial statement income is then adjusted for the following items as detailed in the Inflation Reduction Act:

- Statements covering different tax years;

- Related entities―consolidated financial statements, consolidated returns and partnerships;

- Certain items of foreign income;

- Effectively connected income;

- Certain taxes;

- Disregarded entities;

- Cooperatives;

- Alaska Native corporations;

- Payment of certain tax credits;

- Mortgage-servicing income;

- Defined benefit plans;

- Tax-exempt entities;

- Depreciation;

- Qualified wireless spectrum;

- Financial statement net operating loss; and

- Other items that the Treasury secretary may prescribe.

14. Take action by year-end to avoid excise tax on stock repurchases. The Inflation Reduction Act of 2022 added a 1 percent excise tax on the value of corporate stock buybacks of publically traded companies, which applies to tax years beginning after December 31, 2022. Only repurchases that are treated as redemptions for tax purposes are subject to the tax, and a $1 million exemption is provided. While there are many questions regarding the tax that have yet to be addressed, if your business is considering a stock repurchase, it would likely be best to act in 2022 rather than wait until 2023.

15. Maximize extended and expiring employer credits. For employers who missed out on taking advantage of the employee retention credit (ERC), there is still time to file an amended employment tax return. Generally, there is a three-year statute of limitations to file an amended return that begins when the original employment tax return was filed. However, with respect to quarterly employment tax returns filed in the second and third quarters of 2021, the statute of limitations was extended to five years. While the ERC was designed to encourage businesses to keep workers on their payroll and support small businesses and nonprofits throughout the coronavirus economic emergency, as the economic recovery progressed, the credit was no longer serving its original purpose and expired on October 1, 2021. In order to qualify for the credit, the business must have paid wages while its operations were either completely or partially suspended by government order or during a quarter in which receipts were down 20 percent or more over the same quarter in 2019. A business may also qualify as a recovery startup business that began operations after February 15, 2020.

Another credit, the family and medical leave credit, has been extended through 2025. In order to qualify for this credit, employers’ written policies must provide at least two weeks of paid leave for eligible full-time employees and paid leave must be at least 50 percent of wages paid during a normal workweek. The credit ranges from 12.5 percent to 25 percent of wages paid to qualified employees who are out for a maximum of 12 weeks during the year.

Finally, the work opportunity tax credit is a nonrefundable credit for employers who employ certain individuals from targeted groups, such as veterans, low-income individuals and ex-felons. The size of the credit depends on the hired person’s target group, the number of individuals hired and the wages paid to each. This credit is also scheduled to expire at the end of 2025.

16. Utilize net operating losses (NOL) thoughtfully. Beginning last year, the option to carry an NOL back to a prior tax year was eliminated (except for farming losses and certain insurance companies). NOLs can still be carried forward indefinitely and are also subject to an additional annual limitation of the lesser of 80 percent of current year taxable income or the NOL carryforward. For example, a taxpayer with 2022 taxable income of $3 million and an NOL carryforward of $4 million from a prior year would be able to apply $2.4 million of the NOL carryforward (80 percent of 2022 taxable income) to offset its 2022 taxable income and carry forward the remaining NOL balance of $1.6 million indefinitely.

For estimated tax purposes, a corporation (other than a large corporation) anticipating a small NOL for 2022 and substantial profit in 2023 may find it worthwhile to accelerate just enough of its 2023 income (or defer enough of 2022 deductions) to create a small profit in 2022. Doing so would allow the corporation to base its 2023 estimated tax payments on the small amount of 2022 taxable income, rather than pay 2023 estimates on 100 percent of its 2023 taxable income.

If you are in the position to carry an NOL back (farming and certain insurance companies), but expect to report taxable income in future years, it may be worthwhile to forgo the carryback period in order to apply the NOL to future years where tax rates are expected to be higher. Also, it is important to keep in mind that carrying back a loss could have adverse effects on other items of a tax return. Please analyze the scenarios and discuss with a trusted tax adviser before making any decisions.

17. Be careful of excess business loss limitations. The Tax Cuts and Jobs Act of 2017 (TCJA) effectively limited the amount of business losses that taxpayers were able to use to offset other sources of income for tax years 2018-2025. While the CARES Act reversed the excess business loss (EBL) provisions under TCJA for 2018-2020, the EBL limitations came back into force in 2021―meaning that taxpayers again have to monitor and potentially limit business losses under TCJA. This year, the Inflation Reduction Act of 2022 extended the EBL provisions an additional two years, through 2028.

An EBL is defined as the excess of a taxpayer’s aggregate trade or business deductions over the taxpayer’s aggregate gross trade or business income or gain, plus a statutory threshold of $540,000 for joint filers ($270,000 for other filers). Net trade or business losses in excess of $540,000 for joint filers ($270,000 for other filers) are carried forward as part of the taxpayer’s net operating loss to subsequent tax years.

The CARES Act also clarified several gray areas associated with EBL limitations created by TCJA, including:

- The exclusion of taxpayer wages from trade or business income;

- The exclusion of net operating loss carryforwards from determining a taxpayer’s EBL; and

- Specifying that only trade or business capital gains are included in EBL computations, while excluding net capital losses. The taxpayer is to include in EBL limitations the lesser of either capital gain net income from business sources or capital gain net income.

18. Be sure to receive the maximum benefit for business interest. For 2022, the business interest expense deduction is limited to 30 percent of the adjusted taxable income of the business, applicable at the entity level for partnerships and S corporations. However, certain smaller businesses (with less than an inflation-indexed $27 million in average annual gross receipts for the three-year tax period ending with the prior tax period) are exempt from this limitation.

The deduction limit for net business interest expenses for 2022 is limited to 30 percent of an affected business’ adjusted taxable income. Additionally, the formula to determine adjusted taxable income has yet again changed. For 2022 and forward, depreciation and amortization are no longer allowed to be added back to taxable income when determining the business interest limitation. Interest and taxes are still allowed to be added back.

19. Charitable contribution limits for C corporations revert to pre-CARES Act limits. Corporations are again limited to charitable contributions of 10 percent of taxable income. The passage of the CARES Act in 2020 temporarily increased this limit to 25 percent of taxable income for 2020 and 2021. While the deduction for contribution of food inventory is usually limited to 15 percent of net income, this too was raised to 25 percent for 2020 and 2021; however, this reverted to 15 percent for 2022.

20. Claim a refund of the corporate alternative minimum tax credit. For 2018, the old corporate AMT system was repealed by the TCJA (see item 13 above for discussion of the new corporate AMT system enacted by the Inflation Reduction Act of 2022). Corporations that paid AMT in 2017 and earlier were allowed to carry forward AMT paid as a credit against regular tax. The CARES Act of 2020 allowed corporate taxpayers to claim 100 percent of any remaining credit, regardless of tax liability, in either 2018 or 2019 by filing an amended return for an immediate cash infusion. If your business still has AMT credits remaining, please contact us so we can prepare the necessary filings to get your business’ cash now―and prior to the closing of any statute of limitations to file an amended tax return.

21. Be mindful of PPP forgiveness implications. Congress created the Paycheck Protection Program, better known as “PPP,” back in March 2020 as the COVID-19 pandemic continued to ravage the economy, forcing thousands of businesses to shutter abruptly. The PPP authorized the funding of forgivable loans of up to $10 million per borrower, which qualifying businesses could spend to cover payroll, mortgage interest, rent and utilities expenses. At the end of 2020, Congress approved a second round of PPP funding through the Consolidated Appropriations Act, which also settled the debate as to whether or not taxpayers could deduct, for tax purposes, expenses paid with PPP loan proceeds. In an extremely favorable decision, Congress both excluded the PPP forgiveness from taxable income and also allowed taxpayers to deduct expenses paid for with PPP funding, even if the PPP loan was ultimately forgiven. With this second round of funding occurring largely in early 2021, many taxpayers may have still seen PPP loan forgiveness occurring into 2022.

In order to be considered for PPP loan forgiveness, borrowers need to apply for loan forgiveness within 10 months after the last day of the covered period, generally between eight to 24 weeks from loan disbursement. According to the Small Business Administration (SBA), more than 93 percent of PPP loans had been fully or partially forgiven as of late October 2022. However, the IRS recently has issued guidance addressing improper forgiveness of PPP loans. Even if a PPP loan is forgiven by SBA or the lender, a taxpayer may not exclude the forgiveness from taxable income if (1) a taxpayer was initially ineligible to receive the PPP loan or (2) the forgiveness is based upon misrepresentations or omissions, whether knowingly or unknowingly. The IRS also suggests and encourages taxpayers who want to become tax compliant to file amended returns to include forgiven loan proceed amounts in income if they have inappropriately received forgiveness of their PPP loans. In short, the IRS is taking it upon themselves to add an additional layer of scrutiny upon the SBA in determining which PPP loans, in fact, should not be forgiven. As the Inflation Reduction Act of 2022 adds approximately $45.6 billion to the IRS’ tax enforcement budget, it is almost certain that PPP loans will become a key area of scrutiny. Be proactive to ensure your PPP loan eligibility and forgiveness is compliant, and be ready to demonstrate proper documentation to support your PPP forgiveness in the months and years ahead.

22. Utilize the Restaurant Revitalization Fund before year-end to minimize reporting requirements. Many food and beverage providers took advantage of the Restaurant Revitalization Fund, which acted as a sort of lifeline for restaurants recovering from the pandemic. While funds do not have to be used until March 11, 2023, reporting on the use of funds is required annually. If a business does not use all funds on eligible expenses by December 31, 2022, additional annual reporting submissions to the SBA will be required until the award is fully expended or the performance period ends on March 11, 2023. Restaurants that are close to using all of the funds may wish to accelerate certain expenses and/or double check eligible expenses to date to ensure the funds are spent before year-end to eliminate future reporting requirements.

Virtually any cash-basis taxpayer can benefit from strategies that accelerate deductions or defer income, since it is generally better to pay taxes later rather than sooner (especially when income tax rates are not scheduled to increase). For example, a check you send in 2022 generally qualifies as a payment in 2022, even if the check is not cashed or charged against your account until 2023. Similarly, deductible expenses paid by credit card are not deductible when you pay the credit card bill (for instance, in 2023), but when the charge is made (for instance, in 2022).

With respect to income deferral, cash-basis businesses, for example, can delay year-end billings so that they fall in the following year or accelerate business expenditures into the current year. On the investment side, income from short-term (i.e., maturity of one year or less) obligations like Treasury bills and short-term certificates of deposit is not recognized until maturity, so purchases of such investments in 2022 will push taxability of such income into 2023. For a wage earner (excluding an employee-shareholder of an S corporation with a 50 percent or greater ownership interest) who is fortunate enough to be expecting a bonus, he or she may be able to arrange with their employer to defer the bonus (and tax liability for it) until 2023. However, if any of this income becomes available to the wage earner, whether or not cash is actually received, the bonus will be taxable in 2022. This is known as the constructive receipt doctrine.

23. Review the increased standard deduction. For 2022, the standard deduction has increased slightly to $25,900 for a joint return (an increase of $800) and $12,950 for a single return (an increase of $400). Taxpayers age 65 or older and those with certain disabilities may claim increased standard deductions.

|

Standard deduction (based on filing status) |

2021 |

2022 |

|

Married filing jointly |

$25,100 |

$25,900 |

|

Head of household |

$18,800 |

$19,400 |

|

Single (including married filing separately) |

$12,550 |

$12,950 |

24. Carefully consider obtaining an IP PIN. The Identity Protection (IP) PIN is a six-digit number assigned by the IRS (and known only by the IRS and the taxpayer) that adds an additional layer of protection to the taxpayer’s sensitive tax information. Using an IP PIN prevents someone else from filing a return just by using your Social Security number or Individual Taxpayer Identification Number. Rather, the return must also include your unique IP PIN. While this program was originally only available to confirmed victims of identity theft, the IRS extended its reach to taxpayers who wanted to enroll themselves voluntarily starting in 2021. Receiving and using an IP PIN will further protect your tax information whether you have previously been a victim of identity theft or just want to take precautions to plan ahead and avoid potential identity theft in the future. After you receive your IP PIN from the IRS, it is valid for one calendar year and must be renewed every year after. For greater detail, we previously wrote on this topic in an Alert.

Itemized Deduction Planning

25. Pay any medical bills in 2022. The Consolidated Appropriations Act of 2021 permanently reduced the medical expense deduction floor to 7.5 percent of AGI. In addition, the deduction is no longer an AMT preference item, meaning that even taxpayers subject to the AMT would benefit from deductible medical expenses.

26. Defer your state and local tax payments into 2023. The limitation of the state and local tax deduction was one of the most notable changes enacted by the TCJA in 2017. In 2022, the deduction limit for state and local income or sales and property taxes of $10,000 per return ($5,000 in the case of a married individual filing separately) remains unchanged, though each year more and more states introduce measures to try and circumvent this limitation, such as pass-through entity tax arrangements that will enable a deduction at the individual level. See the next observation below.

As a result, a new type of pass-through entity (PTE) tax strategy has been enacted by many states since the SALT cap of $10,000 was established by TCJA. By imposing an income tax directly on the PTE, a state’s tax on PTE income now becomes a deduction for the PTE for federal income tax purposes.

Currently, 29 states assess such a tax (up from 19 this time last year): Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Georgia, Idaho, Illinois, Kansas, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Utah, Virginia and Wisconsin. The legislatures of Iowa, Pennsylvania and Vermont have proposed PTE tax bills that are still pending. Please contact us to crunch the numbers on this tax to evaluate the potential tax benefits of a workaround strategy.

27. Prepay your January mortgage payment if you will be under the mortgage interest limitation. For acquisition indebtedness incurred after December 15, 2017, the mortgage interest deduction is limited to interest incurred on up to $750,000 of debt ($375,000 in the case of a married individual filing a separate return). The mortgage interest from both a taxpayer’s primary and secondary residences remains deductible up to this balance limit on newer debt. For debt existing prior to December 15, 2017, the limit remains at the pre-TCJA amount of $1 million for original mortgage debt.

Regardless of the date incurred, home equity indebtedness not used to substantially improve a qualified home is no longer deductible. However, if a portion of the funds taken from home equity indebtedness are used to improve the property, an equal percentage of the interest paid on that debt can be deducted.

28. Consider paying state and local taxes, mortgage interest, medical expenses, charitable gifts, etc. (subject to limits noted within this guide) in the same year as opposed to spreading the payments over two years. By bunching deductions and deferring taxable income along with using AGI‑reducing techniques, you increase the value of all deductions and reduce your overall tax liability.

In considering the strategies noted below, however, keep in mind that if you pay a deductible expense in December 2022 instead of January 2023, you reduce your 2022 tax instead of your 2023 tax, but you also lose the use of your money for one month. Generally, this will be to your advantage from a tax perspective, unless in one month you can generate a better return on use of the funds than the tax savings. In other words, you must decide whether the cash used to pay the expense early should be for something more urgent or more valuable than the increased tax benefit.

Taxpayers with fluctuating income should try bunching their SALT payments, itemizing their deductions in one year and taking the standard deduction in the next. For this strategy to work, however, the tax must have been assessed before the payment is made (as determined by the state or local jurisdiction).

Taxpayers can also elect to deduct sales and use tax in lieu of income taxes. Accelerating the purchase of a big-ticket item into this year is a good way to achieve a higher itemized deduction for sales taxes.

The following chart illustrates the tax treatment of selected types of interest.

Interest Expense Deduction Summary*

|

Type of debt |

Not deductible |

Itemized deduction |

Business or above-the-line deduction |

|

Consumer or personal |

X |

|

|

|

Taxable investment [1] |

|

X |

|

|

Qualified residence [2] |

|

X |

|

|

Tax-exempt investment |

X |

|

|

|

Trading and business activities |

|

|

X |

|

Passive activities [3] |

|

|

X |

* Deductibility may be subject to other rules and restrictions.

[1] Generally limited to net investment income.

[2] For 2022, including debt of up to $750,000 ($1 million for debt incurred prior to December 16, 2017) associated with primary and one secondary residence. Home equity loan interest deduction is suspended, unless the loan proceeds are used to buy, build or substantially improve the taxpayer’s home securing the loan.

[3] Subject to passive activity rules.

Charitable Contributions

You may wish to consider paying 2023 pledges in 2022 to maximize the “bunching” effect, perhaps through a donor-advised fund (DAF), which is a charitable giving vehicle that can assist with “bunching” of charitable contributions into a given year. This can be useful when you are able to make a donation but have yet to determine the timing of the distributions out of the donor-advised fund or which charities will receive the gift.

In addition to achieving a large charitable impact in 2022, this strategy could produce a larger two-year deduction than two separate years of itemized deductions, depending on income level, tax filing status and giving amounts each year.

Investment Interest

This is interest on loans used to purchase or carry property held for investment purposes (e.g., interest on margin accounts, interest on debt used to purchase taxable bonds, stock, etc.). Investment interest is fully deductible to the extent of net investment income, unless incurred to purchase securities that produce tax-exempt income. Net investment income is equal to investment income less deductible investment expenses. Sources of investment income include income from interest, nonqualified dividends, rents and royalties. Investment expenses include depreciation, depletion, attorney fees, accounting fees and management fees. If you bunch your investment expenses in one year so that little or no investment interest is deductible, the nondeductible investment interest can be carried forward to the following year.

By rearranging your borrowing, you may be able to convert nondeductible interest to deductible investment interest. In addition, you may be able to increase your otherwise nondeductible investment interest by disposing of property that will generate a short‑term capital gain. The extra investment interest deduction may even offset the entire tax on the gain. Disposing of property that will generate long‑term capital gain will not increase your investment income unless you elect to pay regular income tax rates on the gain. Accordingly, you should review your debt and investment positions before disposing of such property.

Medical and Dental Expenses

As discussed in item 25 above, a medical deduction is allowed only to the extent that your unreimbursed medical outlays exceed 7.5 percent of your AGI. To exceed this threshold, you may have to bunch expenses into a single year by accelerating or deferring payment as appropriate.

Charitable Giving

29. Plan for deduction limits when donating noncash charitable contributions. Donating appreciated securities such as stocks, bonds and mutual funds directly to charity allows a taxpayer to avoid taxes on these capital gains, though the deduction for capital gain property is generally limited to 30 percent of AGI.

For personal property, the charitable deduction for airplanes, boats and vehicles may not exceed the gross proceeds from their resale. Form 1098-C must be attached to tax returns claiming these types of noncash charitable contribution. Furthermore, donations of used clothing and household items, including furniture, electronics, linens, appliances and similar items, must be in “good” or better condition to be deductible. You should maintain a list of such contributions together with photos to establish the item’s condition. To the extent they are not in “good condition,” you will need to secure a written appraisal to deduct individual items valued at more than $500.

Noncash Contribution Substantiation Guide

|

Type of donation |

Amount donated |

|||

|

Less than $250 |

$250 to $500 |

$501 to $5,000 |

Over $5,000 |

|

|

Publicly traded stock |

• Receipt • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

|

Nonpublicly traded stock |

• Receipt • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records • Qualified appraisal • Form 8283 Section B |

|

Artwork |

• Receipt • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records • Qualified appraisal • Form 8283 Section B |

|

Vehicles, boats and airplanes |

• Receipt • Written records |

• Acknowledgment (or 1098-C) |

• 1098-C • Written records |

• Acknowledgment • Written records • Qualified appraisal • Form 8283 Section B |

|

All other noncash donations |

• Receipt • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records • Qualified appraisal • Form 8283 Section B |

|

Volunteer out-of-pocket expenses |

• Receipt • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

• Acknowledgment • Written records |

Conservation easements can have additional benefits that extend beyond federal charitable deductions. At least 14 states have programs that will provide a state tax credit. These programs can be quite involved, and proper procedures with the state must be implemented correctly and timely. However, with the passage of the TCJA and the corresponding SALT limit of $10,000, the IRS has determined that these state credits create an “expectation of a return benefit [that] negates the requisite charitable intent.” Therefore, consultation with a qualified tax professional must be conducted to arrive at the correct charitable conservation easement deduction when a state tax credit is or can be received.

30. Make intelligent gifts to charities. Although there has been much volatility in the stock market this year and the market, as of this writing, is generally still down, gifts of appreciated stock remain a great way to maximize charitable gifting while also avoiding capital gains taxes. Do not give away loser stocks (those that are worth less today than what you paid for them). Instead, sell the shares and take advantage of the resulting capital loss to shelter your capital gains or income from other sources, as explained above. Then give cash to the charity since you just sold the stock and will have the cash on hand. As for winner stocks, give them away to charity instead of donating cash. Under either situation, you recognize multiple tax benefits. When gifting appreciated stock to charity, you not only avoid paying capital gains taxes, gift and estate taxes, but you may be able to deduct the value of the stock for income tax and AMT purposes as well. As always, be aware that gifts to political campaigns or organizations are not deductible.

As in years past, charitable donations are subject to certain AGI limitations. However, unlike in 2020 and 2021, the 100 percent of AGI level for cash donations to a public charity was not extended and has reverted to 60 percent.

Deductions Allowable for Contributions of Various Property

|

|

Cash |

Tangible personal property |

Appreciated property |

|

Public charity |

60% of AGI |

50% of AGI |

30% of AGI |

|

Private operating foundation |

60% of AGI |

30% of AGI |

30% of AGI |

|

Private nonoperating foundation |

30% of AGI |

30% of AGI |

20% of AGI |

|

Donor-advised fund |

60% of AGI |

30% of AGI |

30% of AGI |

31. Consider an investment in a special-purpose entity. As an additional “workaround” to the SALT limitations mentioned previously in item 26, certain states also employ special-purpose entities, which allow taxpayers to make charitable contributions to certain nonprofits (usually schools) while claiming a state tax credit for the contribution. While the taxpayer generally does not receive a federal charitable contribution deduction for the amount of the contribution for which they will receive a state credit, taxpayers often receive a much greater return in tax benefits dollar for dollar than contributions made outside of these special-purpose entity programs. In Pennsylvania, for example, the educational improvement and opportunity scholarship tax credits (EITC/OSTC) allow taxpayers to effectively divert state tax payments to donations to private schools, scholarship organizations, pre-K programs and other education initiatives.

To illustrate, using the Pennsylvania EITC/OSTC program, suppose a taxpayer contributes $50,000 to a special-purpose LLC, which in turn contributes the funds to the EITC/OSTC program. As a member of the LLC, at year end, the taxpayer would receive a K-1 from the entity reporting a Pennsylvania state tax credit for either 75 or 90 percent of the contribution, depending on whether they commit to making this contribution for one or two years, respectively. Assuming a two-year commitment, the taxpayer will receive a $45,000 credit on their Pennsylvania income tax return, reducing the tax owed by $45,000. In addition, the taxpayer would receive a federal income tax charitable contribution deduction for the remaining $5,000. Assuming a 35 percent federal tax bracket, this would result in a federal tax benefit (reduction in tax) of $1,750. Thus, on top of the $45,000 state tax benefit, the total tax benefit from a $50,000 contribution to an EITC/OSTC would be $46,750. By comparison, a contribution to a non-EITC/OSTC qualifying scholarship program would realize a tax benefit of only $17,500 (35 percent of $50,000).

|

|

EITC/OSTC contribution |

“Normal” charitable contribution |

|

Amount of contribution (A) |

$50,000 |

$50,000 |

|

Pennsylvania tax credit (B) |

$45,000 |

$0 |

|

Contribution for which no state credit is given (C=A-B) |

$5,000 |

$50,000 |

|

Federal tax rate (D) |

35% |

35% |

|

Federal tax savings (E=CxD) |

$1,750 |

$17,500 |

|

Total federal and state tax benefit (B+E) |

$46,750 |

$17,500 |

Tax-Efficient Investment Strategies

For 2022, the long-term capital gains and qualifying dividend income tax rates, ranging from zero percent to 20 percent, have increased incrementally, as shown below.

|

Long-Term Capital Gains Rate |

Single |

Married Filing Jointly |

Head of Household |

Married Filing Separately |

|

0% |

Up to $41,675 |

Up to $83,350 |

Up to $55,800 |

Up to $41,675 |

|

15% |

$41,676 - $459,750 |

$83,351 - $517,200 |

$55,801 - $488,500 |

$41,676 - $258,600 |

|

20% |

Over $459,750 |

Over $517,200 |

Over $488,500 |

Over $258,600 |

In addition, a 3.8 percent tax on net investment income applies to taxpayers with modified adjusted gross income that exceeds $250,000 for joint returns ($200,000 for singles). Here are some ways to capitalize on the lower rates as well as other tax planning strategies for investors.

32. Maximize preferential capital gains tax rates. To qualify for the preferential lower 20 percent, 15 percent or zero percent capital gains rates, a capital asset must be held for a minimum of one year. That is why it is important when you sell off your appreciated stocks, bonds, investment real estate and other capital assets to pay close attention to the asset’s holding period. If it is less than a year, consider deferring the sale so you can meet the longer-than-one-year period (unless you have short-term losses to offset the potential gain). While it is generally unwise to let tax implications be your only consideration in making investment decisions, you should not ignore them either. Also, keep in mind that realized capital gains may increase AGI, which in turn may reduce your AMT exemption and therefore increase your AMT exposure―although to a much lesser extent than in years past, given the increased AMT exemptions in recent years.

33. Reduce the recognized gain or increase the recognized loss. When selling off stock or mutual fund shares, the general rule is that the shares acquired first are the ones deemed sold first. However, if you choose to, you can specifically identify the shares you are selling when you sell less than your entire holding of a stock or mutual fund. By notifying your broker of the shares you want sold at the time of the sale, your gain or loss from the sale is based on the identified shares. This sales strategy gives you better control over the amount of your gain or loss and whether it is long- or short-term. One downfall of the specific identification method is that you cannot use a different method (e.g., average cost method or first in, first out method) to identify shares of that particular security in the future. Rather, you will have to specifically identify shares of that particular security throughout the life of the investment, unless you obtain permission from the IRS to revert to the first in, first out method.