Though the end of the year is quickly approaching, there is still time to take advantage of some of the opportunities afforded under the current tax law to reduce your 2024 tax liability.

Nearly 140 Planning Tips and Tax Strategies to Consider for 2024 and 2025

2024 is coming to an end after a year of headlines dominated by the presidential election and continuing conflict across the globe. Once again, however, the economy has been quietly strong. Inflation has continued to decline, the economy has added jobs and stocks are once again near all-time highs. The prognosticators planning for a “soft landing” and slowing growth in 2024 got an even softer landing than they expected, with the S&P 500 having a higher rate of growth for much of 2024 than in 2023. As we enter this holiday season, we hope that you, your family and your loved ones are safe and healthy and find joy in this time of celebration.

Though the end of the year is quickly approaching, there is still time to take advantage of some of the opportunities afforded under the current tax law to reduce your 2024 tax liability. Our 2024 Year-End Tax Planning Guide highlights select and noteworthy tax provisions and potential planning opportunities to consider for this year and, in many cases, 2025.

With the presidential election now behind us, and Republicans with majorities in both the House and Senate, there will be significant tax policy discussions throughout 2025 as the GOP seeks to capitalize on their newfound majorities. We expect that Republican leadership will act quickly and push a budget reconciliation bill in the first quarter of 2025 aimed at extending expiring or expired provisions of the Tax Cuts and Jobs Act of 2017 (TCJA). This bill may also include some of the tax proposals made by President-elect Donald Trump during the campaign, though many expect that Congress will first focus on extending the TCJA and then try to address campaign promises in a second bill later in the year.

Some of the tax proposals from the presidential campaign that Republicans may seek to add to a tax bill include:

- Extending the expiring TCJA provisions, paid for by economic growth or tariffs;

- Eliminating (or increasing) the state and local tax deduction limitation;

- Enacting a 15 percent tax rate for companies that manufacture products in the United States;

- Expanding R&D credits for business;

- Allowing 100 percent expensing on the purchase of business assets;

- Creating family tax credits for caregivers who care for a parent or loved one;

- Exempting tip, overtime and Social Security income from tax;

- Making automobile loan interest deductible; and

- Enacting tax relief for Americans living abroad.

This is a long wish list of tax cuts, so prioritizing certain provisions will be necessary to keep costs down. In addition, due to the slim majority in the House of Representatives, the Republicans cannot lose more than two votes, so they must maintain a tight coalition to get their objectives passed. This also hampers the chances that all of the president-elect’s campaign tax proposals will get passed, as each additional provision can increase the chances of losing a member’s vote.

With that noted, we do expect significant tax legislation in 2025. Without action, tax rates will increase and deductions as well as tax credits will decrease. Of course, with tax legislation, nothing is certain. We continue to carefully monitor and study changing tax legislation. As major tax developments and opportunities emerge, we are always available to discuss the impact on your personal or business situation. Additionally, please keep a watchful eye on our Alerts published throughout the year, which contain information on tax developments and are designed to keep you informed while offering tax-saving opportunities.

In this 2024 Year-End Tax Planning Guide prepared by the CPAs, attorneys and IRS-enrolled agents of the Tax Accounting Group of Duane Morris LLP, along with contributions from the trust and estate attorneys of our firm’s Private Client Services Practice Group, we walk you through the steps needed to assess your personal and business tax situation in light of both existing law and potential law changes, and identify actions needed before year-end and beyond to reduce your 2024 and future tax liabilities.

We hope you find this complimentary guide valuable and invite you to consult with us regarding any of the topics covered or your own unique situation. For additional information, please contact me, Michael A. Gillen, at 215.979.1635 or magillen@duanemorris.com, John I. Frederick, or the practitioner with whom you are regularly in contact.

Wishing you peace, joy, health and happiness this holiday season and beyond.

Michael A. Gillen

Tax Accounting Group

About Duane Morris LLP

Duane Morris LLP, a law firm with more than 900 attorneys in offices across the United States and internationally, is asked by a broad array of clients to provide innovative solutions to today’s legal and business challenges. Evolving from a partnership of prominent lawyers in Philadelphia over a century ago, Duane Morris’ modern organization stretches from the U.S. to the U.K. and across Asia. Throughout this global expansion, Duane Morris has remained committed to preserving its collegial, collaborative culture that has attracted many talented attorneys. The firm’s leadership, and outside observers like the Harvard Business School, believe this culture is truly unique among large law firms and helps account for the firm continuing to prosper throughout changing economic and industry conditions. Most recently, Duane Morris has been recognized by BTI Consulting as both a client service leader and a highly recommended law firm. Additionally, multiple Duane Morris offices have received recognition as top workplaces for consecutive years.

At a Glance

- Offices in 17 U.S. cities in 12 states and the District of Columbia

- Offices in Asia and the United Kingdom, and liaisons in Latin America

- More than 1,600 people

- More than 900 lawyers

- AM Law 100 since 2001

In addition to legal services, Duane Morris is a pioneer in establishing independent affiliates providing nonlegal services to complement and enhance the representation of our clients. The firm has independent affiliates employing more than 100 professionals engaged in other disciplines, such as the tax, accounting and litigation consulting services offered by the Tax Accounting Group.

About the Tax Accounting Group

The Tax Accounting Group (TAG) was the first ancillary practice of Duane Morris LLP and is one of the largest tax, accounting and litigation consulting groups affiliated with any law firm in the United States. Approaching our 45th anniversary in 2026, TAG has an active and diverse practice with over 60 service lines in more than 45 industries, serving as the entrusted advisor to clients in every U.S. state and 25 countries through our regional access, national presence and global reach. In addition, TAG continues to enjoy impressive growth year over year, in large part because of our clients’ continued expression of confidence and referrals. To learn more about our service lines and industries served, please refer to our Quick Reference Service Guide.

TAG’s certified public accountants, certified fraud examiners, attorneys, financial consultants and advisors provide a broad range of cost-effective tax compliance, planning and consulting services as well as accounting, financial and management advisory services to individuals, businesses, estates, trusts and nonprofit organizations. TAG also provides an array of litigation consulting services to lawyers and law firms representing clients in regulatory and transactional matters and throughout various stages of litigation. Our one-of-a-kind CPA and lawyer platform allows us to efficiently deliver one-stop flexibility, customization and specialization to meet each of the traditional, advanced and unique needs of our clients, all with the convenience of a single-source provider.

We serve clients of all types and sizes, from high-net-worth individuals to young and emerging professionals, corporate executives to entrepreneurs, multigenerational families to single and multifamily offices, mature businesses to startups, global professional service firms to local companies, and foundations and nonprofits to governmental entities. We assist clients with a wide range of services, from traditional tax compliance to those with complex and unique needs, conventional tax planning to advanced strategies, domestic to international tax matters for clients working abroad as well as foreign businesses and individuals working in the United States, traditional civil tax representation to those criminally charged, those in need of customary accounting, financial and management advisory services, to those requiring innovative consulting solutions and those in need of sophisticated assistance in regulatory and transactional matters and throughout various stages of litigation.

With our service mission to enthusiastically provide effective solutions that exceed client expectations, and the passion, objectivity and deep experience of our talented professionals, including our dedicated senior staff with an average of over 25 years working together as a team at TAG (with a few having more than 30 years on our platform), TAG is truly distinctive. Being “truly distinctive and positively effective” is not just our TAGline, it is our passion.

Whether you are a client new to TAG or are among the many who have been with us for nearly 45 years, it is our honor and privilege to serve you.

As we approach year-end, we are again fielding calls, outreaches and multiyear tax modeling requests from existing and new clients regarding year-end tax planning strategies available to individuals, businesses, estates, trusts and nonprofits.

Unlike recent years where we had a split Congress―and we expected no meaningful tax changes―one notable tax bill was considered by Congress in 2024: the Tax Relief for American Families and Workers Act of 2024 (TRAFWA), a bipartisan bill that included several individual and business tax breaks.

For individuals, TRAFWA would have enhanced the child tax credit and provided several disaster relief provisions. For businesses, the bill contained full and immediate expensing for R&D costs (instead of amortization over five years), restoring bonus depreciation to 100 percent for tax years 2023-25, and increasing the ability of businesses to claim the business interest expense deduction. While the bill was voted down in the Senate, it is likely that many provisions in the bill will be revisited in the coming legislation session in conjunction with the other tax priorities of the president-elect and Congress.

As previously noted, we are just a little over 12 months from the sunsetting of many provisions passed or modified under the TCJA. While the new Republican Congress will make extending these provisions a priority, many pieces of this legislation are scheduled to sunset at the end of 2025. These provisions include but are not limited to:

- Lower marginal individual income tax rates;

- Nearly doubled standard deductions;

- Elimination of the personal exemption;

- Child tax credit doubling to $2,000, with an increased income threshold;

- State and local income tax deduction limitation of $10,000;

- Reduction of mortgage interest deduction from $1 million of debt to $750,000;

- Higher alternative minimum tax (AMT) exemptions and income thresholds, which dramatically decreased the impact of the individual AMT;

- Qualified business income (QBI/199A) deduction of 20 percent;

- Doubling of the estate and gift exclusion amount;

- Deferring gains through qualified opportunity zones; and

- Establishment of an employer credit for paid family and medical leave.

With so many tax provisions set to expire in such a short time, the next administration and Congress will have their hands full in negotiating the extension and modification of these and other provisions, along with tax policy promises made during the campaign. Please see our in-depth discussion of election results and priorities of the incoming Congress in the next section of this guide. While we do expect that new Congress will be able to extend many of the TCJA provisions, it remains possible that portions of the TCJA could simply expire because our politicians fail to reach agreement on how to extend or modify them. As a result, it is reasonable to at least plan for the possibility that certain tax provisions may generate higher taxes in the future (and starting as early as 2026). It’s never too early to think about the future.

While you can depend on TAG for cost-effective tax compliance, planning and consulting services—as well as critical advocacy and prompt action in connection with your long-term personal and business objectives—we are also available for any immediate or last-minute needs you may have or those that Congress may legislate that impact your personal or business tax situation.

With same or very similar tax rates expected for 2025, the tried-and-true strategy of deferring income and accelerating deductions may be beneficial in reducing tax obligations for most taxpayers in 2024. With minor exceptions, this month is the last chance to develop and implement your tax plan for 2024, but it is certainly not the last opportunity.

For example, if you expect to be in the same tax bracket in 2025 as 2024, deferring taxable income and accelerating deductible expenses can possibly achieve overall tax savings for both 2024 and 2025. However, by reversing this technique and accelerating 2024 taxable income and/or deferring deductions to plan for a possible higher 2025 tax rate, your two-year tax savings may be higher. This may be an effective strategy for you if, for example, you have charitable contribution carryovers to absorb, your marital status will change next year or your head of household or surviving spouse filing status ends this year. This analysis can be complex, and you should seek professional guidance before implementation. Examine our “Words of Caution” section below for additional thoughts in this regard.

This guide provides tax planning strategies for corporate executives, businesses, individuals―including high-income and high-wealth families―nonprofit entities and trusts. We hope that this guide will help you leverage the tax benefits available to you presently, reinforce the tax savings strategies you may already have in place, or develop a tax-efficient plan for 2024 and 2025.

To help you prepare for year-end, below is a quick reference guide of action steps, organized by several common individual scenarios, which can help you reach your tax-minimization goals as long as you act before the clock strikes midnight on New Year’s Eve. Not all of the action steps will apply in your particular situation, but you could likely benefit from many of them. You may want to consult with us to develop and tailor a customized plan with defined multiyear tax modeling to focus on the specific actions that you are considering. We will be pleased to help you analyze the options and decide on the strategies that are most effective for you, your family and your business.

With the presidential election behind us, we now have more clarity as to what to expect in terms of possible future tax reform legislation. As everyone is aware, Donald Trump has made history by becoming the first president in over 100 years to be elected to two nonconsecutive terms. Additionally, Republicans now have a 220-215 member majority in the House of Representatives and a 53-47 member majority in the Senate.

With Republican control of the House, Senate and White House, along with an imminent effective tax hike in the form of the expiring TCJA and a long list of campaign promises made during the year, there is significant political motivation to get a tax bill through Congress. However, it is a rigorous process to get a bill passed, with a bill often undergoing several major revisions before passage. This could result in a significant difference between what the president-elect pitched during his campaign, what the president initially proposed to Congress and the American people, and what actually makes it into the final legislation. Also, since the Republican majority in the Senate is narrow, with less than 60 seats, and it’s unlikely that any Democrat would vote for a tax bill the Republicans are sponsoring, the budget reconciliation procedure will likely need to be used which requires only a simple majority of at least 51 percent of the Senate. This avoids the filibuster, which could potentially stall the bill from passing indefinitely.

The budget reconciliation process does come with significant limitations, however. Bills passed under budget reconciliation cannot significantly increase the deficit beyond a 10-year window, which is why many of the provisions of the TCJA are set to expire after 2025. However, some items in the TCJA, such as the reduction in the corporate tax rate, are permanent. The drafters of the TCJA argued that the economic stimulation that these tax cuts would increase the tax base through growth, which would more than make up for the immediate lost revenue from the rate cut. As a result, these permanent items were deemed to be revenue-neutral after the 10-year window by the Congressional Budget Office, which “scores” bills by calculating their impact on federal revenue and expenses.

Most of the provisions of the TCJA pertaining to individual income taxes are set to expire after December 31, 2025. This includes the qualified business income deduction, reduced tax brackets, increase of the standard deductions, the state and local tax (SALT) deduction limitation, suspension of personal exemptions, doubling of the estate tax exclusion, and doubling of the child tax credit, among others. With the exception of the SALT deduction limitation (which he proposed to eliminate), President-elect Trump has expressed quite often his desires to extend the provisions of the TCJA that are set to expire.

The following provisions are among the most impactful TCJA provisions set to expire at the end of 2025:

|

Key TCJA Provisions Scheduled to Sunset in 2025 |

|||

|

Topic |

Current Law |

2026 Law with no Action |

TAG Comments |

|

Marginal tax rates (married filing jointly shown) |

10% at $0 |

10% at $0 |

If the TCJA is allowed to expire in full, the tax rate impact would be immediate. Seven tax rates would still be in place, but five out of seven of those tax rates would be higher. Additionally, the TCJA modified tax brackets so the top rates did not begin to apply until higher income thresholds were crossed. All 2026 numbers are estimates based on inflation. |

|

12% at $24,500 |

15% at $24,400 |

||

|

22% at $99,550 |

25% at $99,200 |

||

|

24% at $212,200 |

28% at $200,100 |

||

|

32% at $405,050 |

33% at $304,950 |

||

|

35% at $514,400 |

35% at $544,550 |

||

|

37% at $771,550 |

39.6% at $615,100 |

||

|

Capital gains tax brackets |

0%, 15% and 20% rates based on taxable income. |

0%, 15% and 20% capital gains rates tied to ordinary tax bracket. |

Planning should be considered as to whether there is an advantage to recognizing capital gains in 2025 or 2026, as depending upon income, the gain could be subject to a different capital gains rate. |

|

Standard deduction |

$15,450 for single taxpayers. $30,850 for those married filing jointly. |

$8,350 for single taxpayers. $16,700 for those married filing jointly. |

Without action the standard deduction would be reduced to about half of current levels. If reduced, it may be beneficial to defer itemized deductions into 2026 where possible. All 2026 numbers are estimates based on inflation. |

|

State and local tax (SALT) deduction |

$10,000 limitation for both single and married taxpayers. |

Unlimited deduction. |

While an unlimited deduction may sound the most taxpayer friendly, other sunsetting items, such as the Pease limitations and the increased AMT exclusion, will limit the deductibility of these taxes. |

|

Mortgage interest deduction |

Deductible interest limited to debt of $750,000 used to buy, build or substantially improve a primary or secondary residence. |

Deductible interest limited to debt of $1 million used to buy, build or substantially improve a primary or secondary residence plus an additional $100,000 of home equity indebtedness (not used to buy, build or substantially improve). |

With mortgage rates and home prices remaining high, this is one area taxpayers may wish to see sunset. However, the $100,000 home equity indebtedness is an AMT preference item (if not used to buy, build or substantially improve) so AMT considerations may need to be evaluated. |

|

Miscellaneous itemized deductions |

Suspended. |

Miscellaneous itemized deductions (unreimbursed employee expenses, investment expenses, legal and accounting fees, custodial fees, convenience fees and safe deposit box fees) deductible to the extent that the total exceeds 2% of adjusted gross income. |

Also an area some taxpayers may wish to see sunset. If sunsetting, it may be beneficial to delay some expenses into 2026. |

|

Personal and dependent exemptions |

Suspended. |

$5,200 (estimated) per taxpayer and qualified dependent. Exemptions phase out at higher income levels. |

Depending on income level and how many dependents are in each household, this could be a major change. |

|

“Pease” limitation on itemized deductions |

Suspended. |

Reduction of itemized deductions by the lesser of 3% of adjusted gross income (AGI) in excess of specified dollar thresholds, or 80% of total itemized deductions otherwise allowable. The limitation did not apply to medical expenses, investment interest expense, casualty or theft losses, or gambling losses. |

The itemized deduction phaseout could limit the SALT deduction, mortgage interest deduction and charitable deductions. Therefore, if the TCJA sunsets, taxpayers will need to consider the impact of the Pease limitation on their personal tax situation, including whether it makes sense to accelerate certain itemized deductions (such as charitable contributions) into 2025. |

|

Child tax credit |

$2,000 per qualifying child (under age 17), $500 for other dependents. Phaseout of $400,000 for those married filing jointly. |

$1,000 per qualifying child (under age 17). Income phaseout beginning at $110,000 for those married filing jointly. No credit for other dependents. |

Higher credits and higher income phaseouts make this an item taxpayers with dependents would want extended. |

|

Alternative minimum tax for individuals |

Increased exemption ($133,300 for those married filing jointly) and exemption phaseout begins at higher income levels ($1,218,700 for married filing jointly) |

Exemption is reduced to an estimated $104,800 for joint filers and the exemptions phaseout would begin at $199,500. |

With no action, the reduced AMT exemption together with the sunsetting of the $10,000 cap on the SALT deduction would leave more taxpayers back into the land of AMT. AMT exposure would increase particularly for those earning between $400,000 to $600,000 on a joint filing. |

|

Charitable contribution deduction (cash) |

60% of AGI |

50% of AGI |

It may be beneficial to accelerate charitable deductions into 2025. |

|

Section 199A qualified business income (QBI) deduction |

20% |

0% |

If the TCJA sunsets, sole proprietors and pass-through businesses may need to reevaluate whether they should continue to operate as an unincorporated entity due to the loss of the QBI deduction and any other changes in the corporate income tax rates. |

|

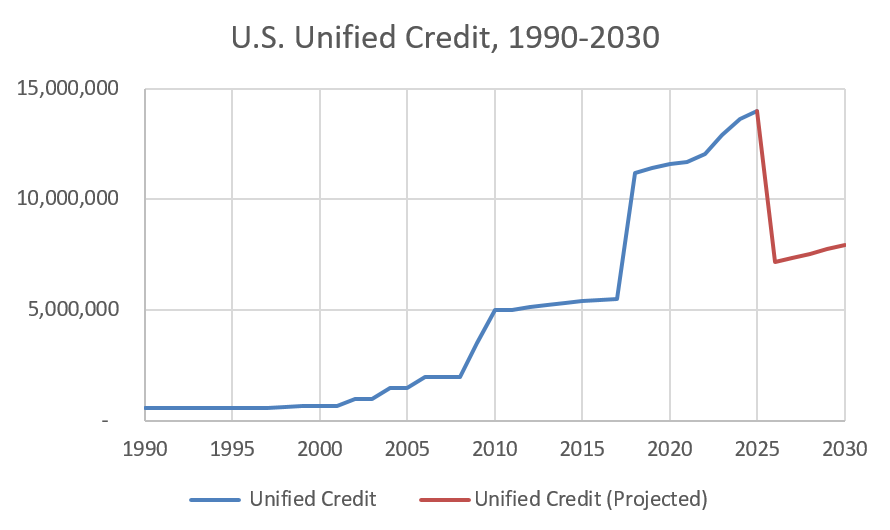

Estate, gift and generation-skipping transfer tax exemption |

$13,610,000 |

Approximately $7 million. |

If TCJA sunsets, estate planning should be carried out in full during 2025. Please look for continued Alerts on this important matter. |

Since Congress is now in a very similar situation to eight years ago, with a slim majority in the Senate, it is almost certain that they will need to utilize the budget reconciliation procedure again to pass any type of TCJA extension or tax reform legislation. This will again restrict the increase that any new legislation can have on the budget deficit to a 10-year window. So, it is possible that the aforementioned TCJA provisions set to expire in 2026 will be extended for up to 10 additional years. While Republicans may want to make many of these cuts permanent, they might not have the ability to do so―and America may not be able to afford to.

In addition, the 2024 presidential campaign saw a lot of promises being made. The most prominent tax proposals President-elect Trump made during his 2024 presidential campaign included:

- Exempt tip income and overtime pay from tax;

- Eliminate tax on Social Security benefits;

- Create family tax credits for caregivers who care for a parent or loved one;

- Allow an interest deduction for personal car loans;

- Eliminate tax filing requirements for American citizens living abroad;

- Decrease the U.S. corporate tax rate to flat 15 percent (potentially just for companies that manufacture products in the United States);

- Reenact 100 percent expensing on the purchase of business assets;

- Repeal the state and local tax deduction limitation; and

- Extend TCJA provisions set to expire in 2026, with particular emphasis on extending the:

- QBI deduction;

- Reduced tax brackets;

- Increased standard deductions; and

- Doubled estate tax exemption.

Whether or not Republicans can form a coalition to enact all of these proposals remains to be seen. In our view, it is unlikely. With the slim majorities in both the House and Senate, Republicans cannot afford to lose more than two votes in each chamber. Also, external factors have changed since 2017 and need to be considered in the context of any potential legislation. Obviously, the world has changed significantly since 2016 when President Trump was first elected and the TCJA was born. Since then, there has been a global pandemic as well as two major wars that the United States has contributed substantial funds and resources to help fight. The U.S. national debt at the time the TCJA was passed was about $20 trillion―now it is a little over $35 trillion. As a result, the annual interest expense eats up a bigger portion of the federal budget each year, making discretionary spending cuts to offset tax cuts more difficult to achieve. Any proposed legislation will be scrutinized by fellow Republicans in Congress, so any disagreements about specific details of the legislation may result in the need for revision, which could significantly slow the process or change the desired outcome.

Getting everyone to agree on all provisions of the tax legislation, particularly new provisions, and ensuring that the legislation meets the budgetary constraints of the reconciliation process will be a tall order indeed. This is why we expect Republicans to break up their tax agenda into two components―first, by extending the TCJA quickly via a reconciliation bill early in the year, which, as of this writing, has the needed support on the Republican side of the aisle. While President-elect Trump’s campaign proposals seem to have support and few critics, some Republican members of Congress are likely to be hesitant to enact tax cuts that would further increase the deficit, even within the 10-year reconciliation window. Thus, any new proposals are likely to have to wait until later in 2025 for consideration, though we expect many proposals to surface in the TCJA extension discussions, as President-elect Trump and Congress attempt to gauge interest and votes. Stay tuned, as this will be an exciting year for tax policy in the United States!

Whether you should accelerate taxable income or defer tax deductions between 2024 and 2025 largely depends on your projected highest (aka marginal) tax rate for each year. While the highest official marginal tax rate for 2024 is currently 37 percent, you might pay more tax than in 2023 even if you were in a higher tax bracket due to credit fluctuations, compositions of capital gains and dividends, and a myriad of other reasons.

The chart below summarizes the most common 2024 tax rates together with the corresponding taxable income levels presently in place. Effective management of your tax bracket can provide meaningful tax savings, as a change of just $1 in taxable income can shift you into the next higher or lower bracket. These differences can be further exacerbated by other income thresholds throughout the Internal Revenue Code, discussed later in this guide, such as those for determining eligibility for the child tax credit and qualified business income deductions, among others. Income deferral and acceleration, while being mindful of bracket thresholds, can be accomplished through numerous income strategies discussed in this guide, such as retirement distribution planning, bonus acceleration or deferral, and harvesting of capital gains and losses.

2024 Federal Income Tax Rate Schedule

|

Tax Rate |

Single |

Head of Household |

Married Couple |

|

10% |

$0 - $11,600 |

$0 - $16,550 |

$0 - $23,200 |

|

12% |

$11,601 - $47,150 |

$16,551 - $63,100 |

$23,201 - $94,300 |

|

22% |

$47,151 - $100,525 |

$63,101 - $100,500 |

$94,301 - $201,050 |

|

24% |

$100,526-$191,950 |

$100,501 - $191,950 |

$201,051 - $383,900 |

|

32% |

$191,951 - $243,725 |

$191,951 - $243,700 |

$383,901 - $487,450 |

|

35% |

$243,726 - $609,350 |

$243,701 - $609,350 |

$487,451 - $731,200 |

|

37% |

Over $609,350 |

Over $609,350 |

Over $731,200 |

While reviewing this guide, please keep the following in mind:

- Never let the tax tail wag the financial dog, as we often preach. Always assess economic viability. This guide is intended to help you achieve your personal and business financial objectives in a “tax efficient” manner. It is important to note that proposed transactions should make economic sense in addition to generating tax savings. Therefore, you should review your entire financial position prior to implementing changes. Various nontax factors can influence your year‑end planning, including a change in employment, your spouse reentering or exiting the work force, the adoption or birth of a child, a death in the family or a change in your marital status. It is best to look at your tax situation for at least two years at a time with the objective of reducing your tax liability for both years combined, not just for 2024. In particular, multiple years should be considered when implementing “bunching” or “timing” strategies, as discussed throughout this guide.

- Be very cautious about accelerated timing causing you to lose too much value, including the time value of money. That is, any decision to save taxes by accelerating income must consider the possibility that this means paying taxes on the accelerated income earlier, which would require you to forego the use of money used to satisfy tax liabilities that could have been otherwise invested. Accordingly, the time value of money can make a bad decision worse or, hopefully, a good decision better―a delicate balance, indeed.

- While the traditional strategies of deferring taxable income and accelerating deductible expenses will be beneficial for many taxpayers, with exceptions, you can often achieve overall tax efficiency by reversing this technique. For example, waiting to pay deductible expenses such as mortgage interest until 2025 would defer the tax deduction to 2025. Or, waiting to pay state and local taxes (SALT) until 2025 if you have already paid SALT of $10,000 in 2024 could also be worthwhile. You should consider deferring deductions and accelerating income if you expect to be in a higher tax bracket next year, you have charitable contribution carryovers to absorb, your marital status will change next year or your head of household or surviving spouse filing status ends this year. This analysis can be complex, and you should seek professional guidance before implementation.

- Both individuals and businesses have many ways to “time” income and deductions, whether by acceleration or deferral. Businesses, for example, can make different types of elections that affect the timing of significant deductions. Faster or slower depreciation, including electing in or out of bonus depreciation, is one of the most significant. This type of strategy should be considered carefully as it will not simply defer a deduction into the following year but can push the deduction out much further or spread it over a number of years.

With these words of caution in mind, the following are observations and specific strategies that can be employed in the waning days of 2024 regarding income and deductions for the year, where the tried-and-true strategies of deferring taxable income and accelerating deductible expenses will result in maximum tax savings.

Below is a quick and easy reference guide of action steps that can help you reach your tax-minimization goals, as long as you act before year-end. In this guide, we have identified the best possible action items for you to consider, depending on how your income shapes up as the year draws to a close.

Not all of the action steps will apply in your particular situation, and some may be better for you than others. In addition, several steps can be taken before year-end that are not necessarily “quick and easy” but could yield even greater benefits. For example, perhaps this is the year that you finally set up your private foundation or a donor-advised fund to achieve your charitable goals (see item 113) or maybe you decide it is time to review your estate plan in order to utilize the current unified credit (see items 117-132). Consultation to develop and tailor a customized plan focused on the specific actions that should be taken is paramount.

To help guide your thinking and planning in light of the multiple situations in which you may find yourself at year-end, we have compiled Quick-Strike Action Steps that follow different themes depending on several common situations. Due to the changing legislative environment, you may wish to consider several situations below and identify the most relevant and significant steps for your particular situation.

Quick-Strike Action Step Themes

|

Situation |

Reason |

Theme |

Action |

|

You expect higher ordinary tax rates in 2025 |

Increased income Getting married, subject to marriage penalty |

Accelerate income into 2024 Defer deductions until 2025 |

Accelerate installment sale gain into 2024 (item 106) Defer SALT payments to 2025 (item 19) Bunch itemized deductions (item 21) |

|

You expect lower ordinary tax rates in 2025 |

Retirement Income goes down

|

Accelerate deductions into 2024 Defer income until 2025 |

Defer income until 2025 (item 13) Maximize medical deductions in 2024 (item 18) Prepay January mortgage (item 20) Consider deduction limits for charitable contributions (items 22 and 23) Sell passive activities (item 39) Increase basis in partnership and S corporation to maximize losses (item 40) Maximize pre-tax retirement contributions (item 41) Maximize contributions to FSAs and HSAs (items 53 and 54) |

|

You have high capital gains in 2024 |

Business or property sold An investment ends Employee stock is sold |

Reduce or defer gains |

Invest in qualified opportunity zones (item 8) Invest in 1202 small business stock (item 28) Perform a like-kind exchange (item 36) Harvest losses (item 27) |

|

You have low capital gains in 2024 |

Carry forward losses |

Increase capital gains |

Maximize preferential gains rates (item 25) |

1. Be aware of increased Form 1099-K reporting for users of Venmo, PayPal, CashApp, Uber, DoorDash and Airbnb users. While Forms 1099-K were initially required to be issued for calendar year 2021 when gross payment card transactions for goods or services exceeded $600, the IRS has once again delayed implementation of this rule. For 2024, the IRS has lowered the threshold to $5,000 from the previous threshold of $20,000, with thresholds dropping to $2,500 in 2025 and $600 in 2026 and after.

2. Take advantage of a 529 to Roth rollover. New for 2024, the SECURE Act 2.0 permits beneficiaries of 529 college savings accounts to make up to $35,000 of direct trustee-to-trustee rollovers from a 529 account to their Roth IRA without tax or penalty. In order to qualify, two requirements must be met:

- The 529 account must have been open for more than 15 years; and

- The rollover must consist of amounts contributed to the 529 account more than five years prior to the conversion, plus earnings on those contributions.

Additionally, rollovers are subject to the Roth IRA annual contribution limits, but are not limited based on the taxpayer's adjusted gross income. Therefore, if a married couple has earned income in 2024 of at least $6,500, they can begin transferring up to the annual contribution limit ($6,500) from the 529 plan account to a Roth IRA, assuming the other provisions above are met. They can make these rollover contributions each year until they max out at the lifetime cap of $35,000. This new provision helps to alleviate any worry taxpayers may have about any surplus 529 plan funds going to waste or being taxed and penalized on distribution. It allows for 529 contributions to potentially be beneficial for more than just a child’s education and help start saving for retirement.

3. Automatic enrollment required beginning January 1, 2025, for newer employer retirement plans. The SECURE Act 2.0 includes an auto-enrollment provision, which for 2025 requires employers to automatically enroll eligible employees into any new 401(k) or 403(b) plans adopted after December 29, 2022. Employees may opt out of participation or reduce the default contribution rate (between 3 percent and 10 percent). For retirement plans already existing prior to December 29, 2022, automatic enrollment would remain optional. Exemptions for this new provision include small businesses with 11 or fewer employees, as well as government and church plans.

4. Enjoy increased contributions to retirement plans in 2025 for individuals between 60 and 63. Beginning in 2025, individuals aged 60 to 63 years old will be allowed to make even higher catch-up contributions, indexed to inflation. For tax year 2025, most 401(k), 403(b), governmental 457 plans and the federal government’s Thrift Savings Plans will allow catch-up contributions for those 50 and over of $7,500. For those taxpayers who are age 60, 61, 62 or 63 in 2025, the catch-up limit is $11,250.

Similarly, taxpayers age 50 and over can contribute catch-up contributions to SIMPLE plans of $3,500 for 2025. However, for those aged 60, 61, 62 and 63, the catch-up contribution limit is $5,250.

5. Not-for-profit and governmental entities can now take advantage of clean energy credits through new IRS election. Newly released regulations now give applicable entities, such as states, local governments, not-for-profits, tribal entities, U.S. territories and other quasi-government agencies, the opportunity to use a new direct pay funding mechanism to promote and accelerate clean energy infrastructure projects. The alternative to the new direct pay funding are traditional financing and debt methods. The entity may elect to treat certain tax credits as a payment against U.S. federal income tax, which would potentially turn the applicable tax credit into a refundable credit from the government, useful for these entities which pay no tax.

This election is available for a number of energy credits under the Inflation Reduction Act of 2022, including the alternative fuel vehicle refueling property credit, renewable electricity production tax credit, commercial clean vehicle and energy ITC credit, to name a few.

6. Claim a deduction for casualty and disaster losses. Notably in 2024, multiple states including all of Alabams, Florida, Georgia, North Carolina and South Carolina, and parts of Tennessee and Virginia, suffered major damage from Hurricanes Helene and Milton and received filing and payment delays. In early October 2024, the IRS announced that affected taxpayers (individuals and/or businesses) in the above areas would have until May 1, 2025, to file and pay their 2024 taxes. Additionally, any taxpayer who did not file their 2023 tax return in the above affected areas also has until May 1, 2025, to file their 2023 individual and/or business tax return. The 2023 penalty relief is limited to late filing as payment for 2023 returns should have been made before the disaster occurred.

Separately, due to other storms, wildfires, landslides, mudslides, straight-line winds, flooding and tornados, affected taxpayers in all of Louisiana and Vermont, all of Puerto Rico and the Virgin Islands and parts of Arizona, Connecticut, Illinois, Kentucky, Minnesota, Missouri, New York, Pennsylvania, South Dakota, Texas and Washington state have until February 3, 2025, to file 2023 returns. Again, this is just a filing delay, as payment should have been made before the disaster occurred. If you have any questions about whether an event qualifies, please do not hesitate to ask for clarification.

For tax purposes, any losses attributed to a federally declared emergency in 2024 can be pushed back into 2023, such as the closure of stores, losses on mark-to-market securities and permanent retirement of fixed assets. However, lost revenues and the decline in fair market value of property as a direct result of economic hardships would not constitute a loss under disaster rules.

For victims of these disasters that have not yet filed their 2023 tax returns, these losses can be included with their 2023 returns filed prior to the extended filing deadline. Currently, taxpayers choosing to claim their losses on their 2023 returns have until October 15, 2025, to make this election. For those that have already filed 2023 returns, it is still possible to go back and amend 2023 filings, especially if 2023 profits could be offset with 2024 disaster losses. The subject of disaster losses remains a very complicated matter, and there are many rules and stipulations that would prevent taxpayers from taking advantage of the election. There are also certain reasons why taxpayers would not want to make the election and, for these reasons, we recommend consulting with us or your qualified tax professional before delving into the amendment process.

7. Consider upgrading to solar panels and take advantage of the updated credit. For the past three years, we have seen continued interest in the expanded solar credits from our clients. The solar investment tax credit currently stands at 30 percent of eligible expenses for projects installed between 2022 and 2032. After 2032, this credit will drop to 26 percent of eligible expenses in 2033 and 22 percent in 2034.

8. Invest in qualified opportunity zones to defer capital gains for two years. Gains can be deferred on the sale of appreciated stock that is reinvested within 180 days into a qualified opportunity fund (QOF). This gain is deferred until the investment is sold or December 31, 2026, whichever is earlier. An individual is able to defer a capital gain as long as the property was sold to an unrelated party. In addition to the deferral of gain, once the taxpayer has held the QOF investment for five years, they are able to increase their basis in the asset by 10 percent of the original gain. Due to this five-year holding period requirement, the QOF investment must have been acquired by December 31, 2021, in order to benefit from this basis step-up.

Although the contribution deadline for this basis increase has passed, a QOF still provides taxpayers the ability to defer capital gains until 2026 or the year in which the investment is sold, whichever is earlier. In addition, tax on the appreciation of the QOF may be avoided if the investment is held for over 10 years.

All states have communities that now qualify. Besides investing in a fund, one can also take advantage of this opportunity by establishing a business in the qualified opportunity zone or by investing in qualified opportunity zone property.

9. Pay close attention to beneficial ownership information reporting (BOIR) originally required by December 31. The Corporate Transparency Act (CTA) of 2021 implemented uniform BOIR requirements for corporations, limited liability companies and other business entities that were created in or are registered to do business in the United States, effective January 1, 2024. In a nutshell, the CTA will require owners of small companies (including single member LLCs) to file a report with the Financial Crimes Enforcement Network (FinCEN) detailing basic information about the beneficial owners of the company, such as names, dates of birth, addresses and identifying numbers. Violations of the CTA and noncompliance with reporting requirements can have severe consequences (a $500-a-day penalty, up to $10,000, and up to two years’ imprisonment), so timely compliance is key.

So who is required to file a beneficial ownership information report, what information must be included and when does it need to be filed? The answer can be found in our June 13, 2023, Alert and December 7, 2023, Alert. Countless businesses are expected to be impacted, and if you assume you will not be affected, you may be risking severe penalties.

On December 3, 2024, the United States District Court for the Eastern District of Texas issued a nationwide preliminary injunction with regard to the CTA and issued a stay with respect to the December 31, 2024, deadline for CTA reports. On December 5, the government appealed this decision to the Fifth Circuit Court of Appeals.

On December 9, 2024, FinCEN posted a statement on their website indicated their intent to comply with the order, and that “reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.”

Thus, while companies are currently not required to register with FinCEN, if the injunction is lifted, compliance may once again be required, and it is unknown what kind of grace period, if any, will be given should the injunction be lifted close to or after December 31, 2024. Therefore, if companies plan to rely on this stay and not file their beneficial ownership reports, they need to be vigilant in monitoring developments as the court cases proceed.

In our view at this moment, the safest course of action is to continue to prepare the BOIRs but refrain from filing them unless/until the injunction is lifted. That way, if the injunction is set aside, you will be ready and able to file on short notice. Otherwise, you run the risk of late filing and penalties.

10. Review the proposed regulations and final regulations for the 1 percent excise tax on stock repurchases. The Inflation Reduction Act added a 1 percent excise tax on the value of corporate stock buybacks of publicly traded companies, which applies to tax years beginning after December 31, 2022. Only repurchases that are treated as redemptions for tax purposes are subject to the tax, and a $1 million exemption is provided. The IRS and Treasury Department released proposed regulations on April 12, 2024, and final regulations on June 28, 2024. Acquisitions of stock of an applicable foreign corporation or a covered surrogate foreign corporation may be treated as stock repurchases subject to the stock repurchase excise tax and treated to different rules depending on if the repurchase occurred before or after the release of the proposed regulations on April 12, 2024.

11. Avoid scams and file a valid employee retention or other expanded tax credit. Due to a growing number of scams and fraudulent activity surrounding the employee retention credit (ERC), the IRS placed an immediate moratorium on the processing of new ERC claims on September 14, 2023. In August, the IRS began processing claims filed after September 14, 2023, but still has a long way to go to clear the 11-month backlog of unprocessed returns. The deadline for filing an ERC claim for the 2020 tax period was April 15, 2024; and the deadline for the 2021 tax period is April 15, 2025. So, if you have not filed already, and your business was eligible for the ERC for any period in 2021, Form 941-X needs to be filed for the applicable quarter soon. While the ERC was designed to encourage businesses to keep workers on their payroll and support small businesses and nonprofits throughout the COVID-19 pandemic, as the economic recovery progressed, the credit was no longer serving its original purpose and expired on October 1, 2021. To qualify for the credit, the business must have paid wages while its operations were either completely or partially suspended by government order or during a quarter in which receipts were down 20 percent or more over the same quarter in 2019. A business may also qualify as a recovery startup business that began operations after February 15, 2020.

Another credit, the family and medical leave credit, has been extended through 2025. In order to qualify for this credit, employers’ written policies must provide at least two weeks of paid leave for eligible full-time employees and paid leave must be at least 50 percent of wages paid during a normal workweek. The credit ranges from 12.5 percent to 25 percent of wages paid to qualified employees who are out for a maximum of 12 weeks during the year.

Finally, the work opportunity tax credit is a nonrefundable credit for employers who employ certain individuals from targeted groups, such as veterans, low-income individuals and ex-felons. The size of the credit depends on the hired person’s target group, the number of individuals hired and the wages paid to each. This credit is also scheduled to expire at the end of 2025.

12. Consider withdrawing erroneous employee retention credit claims. Despite increasing scrutiny and direct warnings from the IRS, ERC solicitors are still pushing businesses to submit aggressive and ineligible ERC claims. With the increased funding the IRS has received from the Inflation Reduction Act of 2022, the IRS has turned its attention to enforcement in this area, resulting in several lawsuits against these unscrupulous promotors, both by the IRS and their clients. Any business with a pending ERC claim that they realized after filing was ineligible can voluntarily withdrawal the claim, as long as the following conditions are met:

- You filed an amended employment tax return to claim the ERC (Forms 941-X, 943-X, 944-X, CT-1X).

- You made no other changes on your amended return besides claiming the ERC.

- You intend to withdraw the entire amount of your ERC claim for the quarter.

- You have yet to receive the refund checks for the claim or you have not cashed or deposited the refund check if the IRS has already processed your returns and paid your claim.

You will receive a letter from the IRS stating whether the withdrawal request was accepted or rejected. Without the acceptance letter, the withdrawal request is not considered completed. If your withdrawal is accepted, an amended income tax return may need to be prepared.

Nearly all cash-basis taxpayers can benefit from strategies that accelerate deductions or defer income, since it is generally better to pay taxes later rather than sooner (especially if income tax rates are not scheduled to increase). For example, a check you send in 2024 generally qualifies as a payment in 2024, even if it is not cashed or charged against your account until 2025. Similarly, deductible expenses paid by credit card are not deductible when you pay the credit card bill (for instance, in 2025), but when the charge is made (for instance, in 2024).

With respect to income deferral, cash-basis businesses, for example, can delay year-end billings so that they fall in the following year or accelerate business expenditures into the current year. On the investment side, income from short-term (i.e., maturity of one year or less) obligations like Treasury bills and short-term certificates of deposit is not recognized until maturity, so purchases of such investments in 2024 will push taxability of such income into 2025. For a wage earner (excluding an employee-shareholder of an S corporation with a 50 percent or greater ownership interest) who is fortunate enough to be expecting a bonus, he or she may be able to arrange with their employer to defer the bonus (and tax liability for it) until 2025. However, if any of this income becomes available to the wage earner, whether or not cash is actually received, the bonus will be taxable in 2024. This is known as the constructive receipt doctrine.

13. Defer income until 2025 to take advantage of sizable inflation adjustments to tax brackets. For 2024, the top individual tax rate remains 37 percent and is applied to joint filers with taxable income greater than $731,200 and single filers with taxable income greater than $609,350. These thresholds will rise in 2025 to $751,600 for joint filers and $626,350 for single filers. It might be advantageous for many taxpayers to accelerate their deductions into 2024, reducing their potential tax liability this year. Additionally, for those who are able, taxpayers should plan to defer income into 2025 to take full advantage of the threshold increases to the tax brackets. While there are many ways to defer your income, waiting to recognize capital gains or exercise stock options are popular options that would not only lower your investment income, but your taxable income as well. Depending on your situation, these strategies could reduce tax due for 2024 and potentially 2025 as well.

14. Be aware of the second largest increase to the standard deduction since the Tax Cuts and Jobs Act. Thanks to high inflation adjustments for 2024, the standard deduction has again increased meaningfully to $29,200 for a joint return (an increase of $1,500) and $14,600 for a single return (an increase of $750) for those who do not itemize deductions. Taxpayers 65 years or older and those with certain disabilities may claim additional standard deductions.

|

Standard deduction (based on filing status) |

2023 |

2024 |

|

Married filing jointly |

$27,700 |

$29,200 |

|

Head of household |

$20,800 |

$21,900 |

|

Single (including married filing separately) |

$13,850 |

$14,600 |

15. Carefully consider obtaining an IP PIN. The Identity Protection (IP) PIN is a six-digit number assigned by the IRS (and known only by the IRS and the taxpayer) that adds an additional layer of protection to the taxpayer’s sensitive tax information. Using an IP PIN prevents someone else from filing a return just by using your Social Security number or Individual Taxpayer Identification Number. Rather, the return must also include your unique IP PIN. Therefore, receiving and using an IP PIN will further protect your tax information whether you have previously been a victim of identity theft or just want to take precautions to plan ahead and avoid potential identity theft in the future. After you receive your IP PIN from the IRS, it is valid for one calendar year and, for each subsequent year, a new IP PIN will be generated and must be obtained. For greater detail, we previously wrote on this topic in an Alert. Additionally, the IRS has an FAQ about the IP PIN.

16. Maximize child and dependent care credits. For tax year 2024, you may be able to claim the nonrefundable child and dependent care credit if you pay qualified expenses when you (and your spouse if filing a joint return) work. This credit is generally not allowed for married filing separately taxpayers. Your dependent must be under age 13, or an individual who was physically or mentally incapable of self-care with certain conditions. The maximum qualifying expenses you may use to calculate the credit are $3,000 for one qualifying individual and $6,000 for two or more qualifying individuals. In 2024, there is no limit to a taxpayer’s adjusted gross income (AGI) in qualifying for the credit; however, the percentage of expenses available for credit would be reduced to 20 percent for most middle-income taxpayers whose AGI exceeds $43,000.

|

Percentage of Expenses Available for Dependent Care Credit (Based on Income) |

|||

|

|

35% |

34% to 21% |

20% |

|

Adjusted gross income |

$0 to $15,000 |

$15,001 to $43,000 |

$43,001 and above |

17. Claim the maximum child tax credit. For 2024, the maximum credit remains at $2,000 per dependent under the age of 17. The refundable portion of the credit can go up to $1,700 per qualifying child (up from $1,600 in 2023 to adjust for inflation), depending on your income, and you must have earned income of at least $2,500 to even be eligible for the refund. Similar to 2023, the credit begins to phase out at incomes above $400,000 for married filing jointly taxpayers and $200,000 for any other filing status.

Phaseout Range of Child Tax Credit by Modified Adjusted Gross Income

|

Single/Married Filing Separately |

Head of Household |

Married Filing Jointly |

|

$200,000 - $240,000 |

$200,000 - $240,000 |

$400,000 - $440,000 |

Itemized Deduction Planning

18. Pay any medical bills in 2024. The medical expense deduction floor remains at 7.5 percent of AGI for taxpayers who itemize their deductions. Additionally, the deduction is not an alternative minimum tax (AMT) preference item, meaning that even taxpayers who are subject to the AMT benefit from deductible medical expenses.

Therefore, be sure to pay all medical costs for you, your spouse and any qualified dependents in 2024 if, with payment, your medical expenses are projected to exceed 7.5 percent of your 2024 AGI, as this will lower your tax liability for 2024. You also may wish to accelerate any qualified elective medical procedures into 2024 if appropriate and deductible.

19. Defer your state and local tax payments until 2025. The limitation of the state and local tax deduction was one of the most notable changes enacted by the TCJA in 2017. In 2024, the deduction limit for state and local income or sales and property taxes of $10,000 per return ($5,000 in the case of a married individual filing separately) remains unchanged, though each year more and more states introduce measures to try and circumvent this limitation, such as pass-through entity (PTE) tax arrangements that will enable a deduction at the individual level. See the next observation below.

As a result, a newer type of PTE tax strategy has been enacted by many states since the SALT cap of $10,000 was established by TCJA. By imposing an income tax directly on the PTE on behalf of the respective owners, a state’s tax on PTE income now becomes a deduction for the PTE for federal income tax purposes. Generally, states with PTE elections fall within two categories: a deduction for previously taxed income (reducing state taxable income on the owner’s individual return), or a credit for the tax liability incurred by the PTE (reducing the state tax liability dollar-for-dollar on the owner’s individual return).

Currently, 36 states (up from 29 last year) and one locality assess such a tax: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Mississippi, Montana, Nebraska, New Jersey, New Mexico, New York, New York City, North Carolina, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, Utah, Virginia, West Virginia and Wisconsin. The legislature of Pennsylvania has proposed PTE tax bills in the state Senate and House that are still pending. See item 82 for more information. Please contact us or your qualified tax professional to crunch the numbers on this tax to evaluate the potential tax benefits of a workaround strategy.

20. Prepay your January mortgage payment if you will be under the mortgage interest limitation. For acquisition indebtedness incurred after December 15, 2017, the mortgage interest deduction is limited to interest incurred on up to $750,000 of debt ($375,000 in the case of a married individual filing a separate return). The mortgage interest from both a taxpayer’s primary and secondary residences remains deductible up to this balance limit on newer debt. For debt existing prior to December 15, 2017, the limit remains at the pre-TCJA amount of $1 million for original mortgage debt.

Regardless of the date incurred, home equity indebtedness not used to substantially improve a qualified home is no longer deductible. However, if a portion of the funds taken from home equity indebtedness are used to improve the property, an equal percentage of the interest paid on that debt can be deducted.

21. Consider paying state and local taxes, mortgage interest, medical expenses, charitable gifts, etc. (subject to limits noted within this guide) in the same year as opposed to spreading the payments over two years. By bunching deductions and deferring taxable income along with using AGI‑reducing techniques, you increase the value of all deductions and reduce your overall tax liability.

In considering the strategies noted below, however, keep in mind that if you pay a deductible expense in December 2024 instead of January 2025, you reduce your 2024 tax instead of your 2025 tax, but you also lose the use of your money for one month. Generally, this will be to your advantage from a tax perspective, unless in one month you can generate a better return on use of the funds than the tax savings. In other words, you must decide whether the cash used to pay the expense early should be for something more urgent or more valuable than the increased tax benefit.

Taxpayers with fluctuating income should try bunching their SALT payments, itemizing their deductions in one year and taking the standard deduction in the next. For this strategy to work, however, the tax must have been assessed before the payment is made (as determined by the state or local jurisdiction).

Taxpayers can also elect to deduct sales and use tax in lieu of income taxes. Accelerating the purchase of a big-ticket item into this year is a good way to achieve a higher itemized deduction for sales taxes.

The following chart illustrates the tax treatment of selected types of interest.

|

Interest Expense Deduction Summary* |

|||

|

Type of debt |

Not deductible |

Itemized deduction |

Business or above-the-line deduction |

|

Consumer or personal |

✔ |

|

|

|

Taxable investment [1] |

|

✔ |

|

|

Qualified residence [2] |

|

✔ |

|

|

Tax-exempt investment |

✔ |

|

|

|

Trading and business activities |

|

|

✔ |

|

Passive activities [3] |

|

|

✔ |

* Deductibility may be subject to other rules and restrictions.

[1] Generally limited to net investment income.

[2] For 2024, including debt of up to $750,000 ($1 million for debt incurred prior to December 16, 2017) associated with primary and one secondary residence. Home equity loan interest deduction is suspended, unless the loan proceeds are used to buy, build or substantially improve the taxpayer’s home securing the loan.

[3] Subject to passive activity rules.

Charitable Contributions

You may wish to consider paying 2025 pledges in 2024 to maximize the “bunching” effect, perhaps through a donor-advised fund, which is a charitable giving vehicle that can assist with bunching of charitable contributions into a given year. This can be useful when you are able to make a donation but have yet to determine the timing of the distributions out of the donor-advised fund or which charities will receive the gift.

In addition to achieving a large charitable impact in 2024, this strategy could produce a larger two-year deduction than two separate years of itemized deductions, depending on income level, tax filing status and giving amounts each year.

Investment Interest

This is interest on loans used to purchase or carry property held for investment purposes (e.g., interest on margin accounts, interest on debt used to purchase taxable bonds, stock, etc.). Investment interest is fully deductible to the extent of net investment income, unless incurred to purchase securities that produce tax-exempt income. Net investment income is equal to investment income less deductible investment expenses. Sources of investment income include income from interest, nonqualified dividends, rents and royalties. Investment expenses include depreciation, depletion, attorney fees, accounting fees and management fees. If you bunch your deductible investment expenses in one year so that little or no investment interest is deductible, the nondeductible investment interest can be carried forward to the following year.

By rearranging your borrowing, you may be able to convert nondeductible interest to deductible investment interest. In addition, you may be able to increase your otherwise nondeductible investment interest by disposing of property that will generate a short‑term capital gain. The extra investment interest deduction may even offset the entire tax on the gain. Disposing of property that will generate long‑term capital gain will not increase your investment income unless you elect to pay regular income tax rates on the gain. Accordingly, you should review your debt and investment positions before disposing of such property.

Medical and Dental Expenses

As discussed in item 18 above, a medical deduction is allowed only to the extent that your unreimbursed medical outlays exceed 7.5 percent of your AGI. To exceed this threshold, you may have to bunch expenses into a single year by accelerating or deferring payment as appropriate.

Charitable Giving

22. Plan for deduction limits when donating noncash charitable contributions. Donating appreciated securities such as stocks, bonds and mutual funds directly to charity allows a taxpayer to avoid taxes on these capital gains, though the deduction for capital gain property is generally limited to 30 percent of AGI.

For personal property, the charitable deduction for airplanes, boats and vehicles may not exceed the gross proceeds from their resale. Form 1098-C must be attached to tax returns claiming these types of noncash charitable contribution. Furthermore, donations of used clothing and household items, including furniture, electronics, linens, appliances and similar items, must be in “good” or better condition to be deductible. You should maintain a list of such contributions together with photos to establish the item’s condition. To the extent they are not in “good condition,” you will need to secure a written appraisal to deduct individual items valued at more than $500.

|

Noncash Contribution Substantiation Guide |

||||

|

Type of donation |

Amount donated |

|||

|

Less than $250 |

$250 to $500 |

$501 to $5,000 |

Over $5,000 |

|

|

Publicly traded stock |

•Receipt |

•Acknowledgment |

•Acknowledgment |

•Acknowledgment |

|

Nonpublicly traded stock |

•Receipt |

•Acknowledgment |

•Acknowledgment |

•Acknowledgment |

|

Artwork |

•Receipt |

•Acknowledgment |

•Acknowledgment |

•Acknowledgment |

|

Vehicles, boats and airplanes |

•Receipt |

•1098-C or |

•1098-C and |

•1098-C |

|

All other noncash donations |

•Receipt |

•Acknowledgment |

•Acknowledgment |

•Acknowledgment |

|

Volunteer out-of-pocket expenses |

•Receipt |

•Acknowledgment |

•Acknowledgment |

•Acknowledgment |

Conservation easements can have additional benefits that extend beyond federal charitable deductions. At least 16 states have programs that will provide a state tax credit. These programs can be quite involved, and proper procedures with the state must be implemented correctly and timely. However, with the passage of the TCJA and the corresponding SALT limit of $10,000, the IRS has determined that these state credits create an “expectation of a return benefit [that] negates the requisite charitable intent.” Therefore, consultation with a qualified tax professional must be conducted to arrive at the correct charitable conservation easement deduction when a state tax credit is or can be received.

It is also important to consider that a conservation easement will have an effect on the tax basis of the property. If selling the property, it is important to remember the impact of the easement on the tax basis when calculating gain. If changing tax service providers, it is important to hand your tax advisor all documents related to any prior year easements no matter how long ago the easement was obtained.

23. Make intelligent gifts to charities. With many stocks gaining ground in 2024, gifts of appreciated stock remain a great way to maximize charitable gifting while also avoiding capital gains taxes. Do not give away loser stocks (those that are worth less today than what you paid for them). Instead, sell the shares and take advantage of the resulting capital loss to shelter your capital gains or income from other sources, as explained above. Then give cash to the charity since you just sold the stock and will have the cash on hand. As for winner stocks, give them away to charity instead of donating cash, as long as you have held the stock for more than one year. Under either situation, you recognize multiple tax benefits. When gifting appreciated stock to charity, you not only avoid paying taxes on capital gains, gifts and estates, but you may be able to deduct the value of the stock for income tax and AMT purposes as well. As always, be aware that gifts to political campaigns or organizations are not deductible.

Charitable donations are subject to the same AGI limitations in 2024 as for 2023.

|

Deductions Allowable for Contributions of Various Property |

|||

|

|

Cash |

Tangible personal property |

Appreciated property |

|

Public charity |

60% of AGI |

50% of AGI |

30% of AGI |

|

Private operating foundation |

60% of AGI |

30% of AGI |

30% of AGI |

|

Private nonoperating foundation |

30% of AGI |

30% of AGI |

20% of AGI |

|

Donor-advised fund |

60% of AGI |

30% of AGI |

30% of AGI |

24. Consider an investment in a special-purpose entity. As an additional workaround to the SALT limitations mentioned previously in items 19 and 21, certain states also employ special-purpose entities, which allow taxpayers to make charitable contributions to certain nonprofits (usually schools) while claiming a state tax credit for the contribution. While the taxpayer generally does not receive a federal charitable contribution deduction for the amount of the contribution for which they will receive a state credit, taxpayers often receive a much greater return in tax benefits dollar-for-dollar than contributions made outside of these special-purpose entity programs. In Pennsylvania, for example, the educational improvement and opportunity scholarship tax credits (EITC/OSTC) allow taxpayers to effectively divert state tax payments to donations to private schools, scholarship organizations, pre-K programs and other education initiatives.

To illustrate, using the Pennsylvania EITC/OSTC program, suppose a taxpayer contributes $50,000 to a special-purpose LLC, which in turn contributes the funds to the EITC/OSTC program. As a member of the LLC, at year end, the taxpayer would receive a K-1 from the entity reporting a Pennsylvania state tax credit for either 75 percent or 90 percent of the contribution, depending on whether they commit to making this contribution for one or two years, respectively. Assuming a two-year commitment, the taxpayer will receive a $45,000 nonrefundable credit on their Pennsylvania income tax return, reducing the tax owed by $45,000. In addition, the taxpayer would receive a federal income tax charitable contribution deduction for the remaining $5,000. Assuming a 37 percent federal tax bracket, this would result in a federal tax benefit (reduction in tax) of $1,850. Thus, on top of the $45,000 state tax benefit, the total tax benefit from a $50,000 contribution to an EITC/OSTC would be $46,850. As the credit is nonrefundable, this assumes that the taxpayer’s state tax liability exceeds the amount of the credit. By comparison, a contribution to a non-EITC/OSTC qualifying scholarship program would realize a tax benefit of only $18,500 (37 percent of $50,000).

|

|

EITC/OSTC contribution |

“Normal” charitable contribution |

|

Amount of contribution (A) |

$50,000 |

$50,000 |

|

Pennsylvania tax credit (B) |

$45,000 |

$0 |

|

Contribution for which no state credit is given (C=A-B) |

$5,000 |

$50,000 |

|

Federal tax rate (D) |

37% |

37% |

|

Federal tax savings (E=CxD) |

$1,850 |

$18,500 |

|

Total federal and state tax benefit (B+E) |

$46,850 |

$18,500 |

Tax-Efficient Investment Strategies

For 2024, the long-term capital gains and qualifying dividend income tax rates, ranging from zero percent to 20 percent, are based on taxable income and have increased incrementally, as shown below.

|

Long-Term Capital Gains Rate |

Single |

Married Filing Jointly |

Head of Household |

Married Filing Separately |

|

0% |

Up to $47,025 |

Up to $63,000 |

Up to $47,025 |

Up to $94,050 |

|

15% |

$47,026 to $518,900 |

$63,001 to $551,350 |

$47,026 to $291,850 |

$94,051 to $583,750 |

|

20% |

Over $518,900 |

Over $551,350 |

Over $291,850 |

Over $583,750 |

In addition, a 3.8 percent tax on net investment income applies to taxpayers with modified AGI that exceeds $250,000 for joint returns ($200,000 for singles). See item 64 for more information. Here are some ways to capitalize on the lower rates as well as other tax planning strategies for investors.

25. Maximize preferential capital gains tax rates. In order to qualify for the preferential lower capital gains tax rates of 20 percent, 15 percent and zero percent, a capital asset is required to be held for a minimum of one year. That is why it is paramount that, when you sell off your appreciated stocks, bonds, investment real estate and other capital assets, you are mindful of the asset’s holding period. If you have held the asset for less than one year, consider delaying the sale so that you can meet the holding period requirement (unless you have losses to offset any potential gain). Also, consider timing the sales strategically to stay within the lower tax brackets and take advantage of the zero percent or 15 percent long-term capital gains rates when possible. While it is generally unwise to let tax implications be your only determining factor in making investment decisions, you should not completely ignore them either. Also, keep in mind that realized capital gains may increase your AGI, which consequently may reduce your AMT exemption and therefore increase your AMT exposure―although this is to a much lesser extent than in prior years, given the increased AMT exemptions in recent years.

26. Reduce the recognized gain or increase the recognized loss. When selling off any securities, the general rule is that the shares acquired first are the ones deemed sold first. However, if you opt to, you can specifically identify the shares you are selling when you sell less than your entire holding of any securities. By notifying your broker of the shares you wish to have sold at the time of the sale, your gain or loss from the sale is based on the identified shares. Additionally, many self-directed brokerage accounts also allow you to choose which shares to sell first. This sales strategy gives you more control over the amount of your gain or loss and whether it is long- or short-term. A pitfall of the specific identification method is that you cannot use any different methods (e.g., average cost method or first in, first out method) to identify shares of that particular security in the future. Rather, you will have to specifically identify shares of that particular security throughout the life of the investment, unless you obtain permission from the IRS to revert to the first in, first out method.

27. Harvest your capital losses. You should periodically review your investment portfolio to determine if there are any “losers” you should sell off. This year, even if your investments are collectively up, there are likely capital losses lurking somewhere in your portfolio. As the year comes to a close, so does your last chance to offset capital gains recognized during the year or to take advantage of the $3,000 ($1,500 for married separate filers) limit on deductible net capital loses, as potentially up $3,000 of net losses can be used to offset any ordinary income reported during the year. However, please be mindful of the wash-sale rule that could negate any capital losses realized, discussed later in item 30.